Pension fund and part-time work: Mind the pension gap!

More and more people in Switzerland are working part-time. However, the lower wages earned from part-time work have an impact on pension funds: There is a risk of a pension gap. This makes private retirement provision all the more important.

In the past, it was primarily mothers who reduced their working hours in order to look after their children. Today that’s changed. A time-consuming hobby, volunteer work, part-time self-employment, or simply a healthy work-life balance can also be reasons for working part-time. More and more people are enjoying the privilege of organizing their daily lives according to their own ideas.

But as attractive as part-time work is, it also has disadvantages. Especially for retirement provision. The Swiss pension system has grown over time and is therefore designed for full-time employees. A part-time salary that is enough to live on now can become a problem in old age. Contact the OASI and check your pension fund statement to find out what benefits you can expect after retirement. This leaves you enough time to close any gaps in your personal retirement provision.

Working part-time in Switzerland

Part-time work has become very popular in Switzerland. According to the Federal Statistical Office, almost 42% of people in gainful employment work part-time. This puts Switzerland at the top of Europe (19%): Only in the Netherlands (43%) is there more part-time work.

In Switzerland, women are three times more likely to work part-time than men. When returning to work after maternity leave, most women reduce their working hours – and do so on a long-term basis. If there is at least one child under the age of 13 in the household, the mother works part-time in 80% of cases.

Why do part-time jobs mean lower retirement savings?

If you work less, you earn less money, which means you also pay lower contributions into the OASI (state pension = Pillar 1) and into the pension fund (occupational benefits insurance = Pillar 2). This usually leads to lower benefits later on.

Breaks from work have an even greater impact on occupational benefits. Many mothers stay at home for a few years to be there for their children. But every missing contribution year results in a lower OASI pension. This is why women tend to be in a worse position when it comes to pensions, and makes private retirement provision all the more important, especially for women.

What is a pension gap?

The difference between the benefits paid out (retirement pension) and the actual cost of living. As a rule of thumb, you will need around 80%of your current income after retirement to maintain your accustomed standard of living. If you work full-time, you will earn around 60% of your previous salary with Pillars 1 and 2 combined. This results in a gap of 20% in retirement provision. However, people who have worked part-time for many years may face a much larger gap.

What requirements are there for a full OASI pension?

For the maximum pension of CHF 2,520 (as of 2026), there are three requirements:

- 44 years of contribution payments (from age 21 until retirement)

- Average annual income of CHF 90,720 (as of 2026) or

- Sufficient education/care credits to compensate for the loss of salary

These conditions cannot always be met, especially in the case of part-time work. This means that only a partial pension will be paid after retirement.

Education and care credits

If you have raised children or look after relatives in need of care, you can have this credited to the OASI.

- Education credits are taken into account only when applying for the retirement pension.

- An application for care credits for caring for relatives must be submitted to the cantonal compensation office every year. The compensation office then checks whether the necessary conditions have been met.

Pension fund: What are the disadvantages of part-time work?

The pension fund only considers persons with an annual minimum income. Another problem for part-time work is the coordination deduction – in the worst case, it is even deducted twice, with serious consequences for retirement provision.

OPA entry threshold

In Switzerland, employers only have to enroll their employees in the pension fund if their annual income exceeds CHF 22,680 (as of 2026). This means that retirement assets are generally not saved for low annual incomes.

Coordination deduction

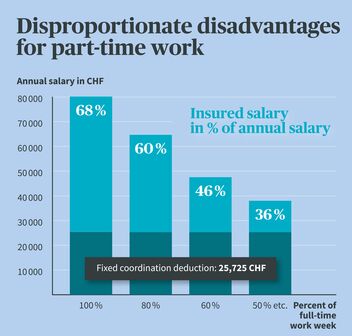

The law requires that Pillars 1 and 2 must be coordinated: The pension fund should insure only that part of the salary that is not already covered by the OASI/DI. The coordination deduction therefore prevents double insurance. Specifically, the calculation is gross annual salary − coordination deduction = salary insured under OPA.

The coordination deduction is a fixed amount, namely 7/8 of the maximum OASI pension (2026: CHF 26,460). And here’s the problem: Applied to part-time work, the coordination deduction has far to great an impact. As the workload decreases, the pensionable salary falls rapidly.

Tips on the coordination deduction

Talk to your employer: Draw attention to the possibility of adjusting the occupational benefits so that part-time employees are less disadvantaged.

- The coordination deduction may be adjusted in line with the level of employment. This measure counteracts the negative effect that part-time work has on occupational benefits However, such solutions are voluntary and require the willingness of the employer.

- If you work part-time in several jobs, the coordination deduction may be applied twice – once for each pension fund. Then there’s not much of your pensionable salary left over. Find out whether you will be able to insure both incomes in a single pension fund in the future.

More tips for part-time employees

Make sure that there are no gaps in your OASI contributions and that your workload is as high as possible. If you are only willing or able to work a little, save as much money as possible in the voluntary Pillar 3.

Tip 1: Pay the OASI minimum contribution

You can avoid contribution gaps by paying in the minimum OASI contribution of CHF 530 each year (as of 2026). If a gap does occur, the OASI minimum contribution can be paid back within five years. On request, the compensation office will provide you with a statement of your personal OASI account.

Tip 2: Increase working hours

The Swiss Conference of Gender Equality Delegates recommends that working hours should not fall below 70% in the long term to ensure sound retirement provision. Lower working hours over the long term have a major impact on personal retirement provision.

Tip 3: Pillar 3a/3b and using investments

People who work part-time are generally affected by pension gaps. In particular, mothers without Pillar 3 often have to live on the subsistence minimum after retirement. Avoid this by taking the initiative yourself and systematically increasing your future retirement pension.

- Pillar 3a: Employees can pay up to CHF 7,258 a year (as of 2026) into Pillar 3a and deduct this amount from their taxable income. Self-employed persons can pay in up to 20% of their annual income subject to OASI contributions, up to a maximum of CHF 36,288 (as of 2026). As restricted provision, Pillar 3a capital is not freely available.

- Pillar 3b: Alternatively or in addition, you can pay into Pillar 3b – with no limit on the amount, but without a tax exemption. With flexible provision, you can access the capital you have saved at any time.

- Investments: Start saving as early as possible to benefit from compound interest. Even small amounts are worthwhile. Put your money to work by investing in funds or equities, for example. The easiest way to do this is with Pillar 3a pension solutions such as our SmartFlex pension plan, which can be tailored to your personal needs.