Pillar 2

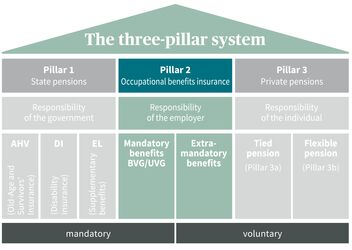

Occupational benefits insurancePillar 2 of the Swiss three-pillar systems consists of mandatory occupational benefits insurance (BVG). The Swiss Federal Act on Occupational Retirement, Survivors' and Disability Pension Plans (BVG) constitutes a legal framework laying out the minimum requirements for private occupational benefits institutions.

Pillar 2 is intended to guarantee maintenance of the standard of living for people in gainful employment and their family members, because the demographic and economic development of Switzerland now means that an AHV pension from Pillar 1 can only cover the minimum cost of living. Mandatory occupational benefits insurance (BVG) therefore serves the purpose of supplementing the AHV/DI benefits in old age, in the event of disability or in a death case.

What is the structure of Pillar 2?

Mandatory occupational benefits insurance consists of one mandatory portion and another extra-mandatory (voluntary) portion. Annual salaries up to a specified maximum amount are insured in the mandatory portion (see: maximum effective annual salary for BVG). The portion of the salary above this amount is regarded as extra-mandatory.

The concept of mandatory pension provision covers various risks. For instance, it is activated to provide security in old age (BVG pension), in the event of an accident or disability, or in a death case. Other components of occupational benefits insurance include daily sickness benefits insurance, i.e. ensuring continued salary payments in cases where an employee falls sick, as well as the vested benefits institutions. The following graphic gives you more information about the structure of Pillar 2.

Occupational benefits insurance explained in detail.

Mandatory or extra-mandatory? With or without a contribution obligation? Here, you can learn all the details you need to know about mandatory occupational benefits insurance (BVG).

Contribution obligation and organization

All employees with an annual salary subject to AHV contributions which exceeds the BVG minimum annual salary are obliged to pay contributions and to be covered by insurance. Responsibility for correct coverage under occupational benefits insurance rests with the employer. As with AHV contributions, the employer must pay at least half of the contributions for occupational benefits insurance. Incidentally, self-employed persons make voluntary payments into occupational benefits insurance.

The obligation under the Federal Law on Occupational Old Age, Survivors and Disability Pension Plans (OPA) begins when you start gainful employment and ends for men and women when you reach the reference age (formerly: normal retirement age) of 65. Occupational benefits insurance funds are managed by public or private pension funds or occupational benefits institutions.

Salary subject to mandatory and extra-mandatory insurance

A distinction is made between the mandatory and extra-mandatory portions of the insured annual salary on the basis of the BVG. Annual salaries that are subject to AHV contributions and that exceed the BVG minimum annual salary are subject to mandatory insurance. Insured annual salaries that exceed this maximum amount (maximum effective annual salary for BVG purposes) are allocated to the extra-mandatory portion; in this case, the benefits of the pension fund concerned are voluntary. If you want to build up an additional pension above this amount, you should invest in a suitable 3a private pension product.

Amount of benefits and conversion rate

Insured persons generally become entitled to a retirement pension from occupational benefits insurance after they reach the reference age (formerly: normal retirement age). Depending on the regulations of the pension fund or occupational benefits institution, the entitlement can be claimed as from attainment of age 58. The amounts paid out are determined by the available retirement assets and the defined "conversion rate", by which the retirement assets are multiplied. Sample calculation: With a conversion rate of 6.8% and mandatory retirement assets of (for example) CHF 350,000, the annual pension would be CHF 23,800.

It's important to note that the current legal conversion rates may drop in the future. For this reason, it’s a good idea to plan for your retirement early on and starting paying into a Pillar 3 account to ensure you have enough to retire on.

Entitlement to the credit balance

If you change jobs, the accrued BVG retirement assets will be transferred from your current pension fund into your new employer’s fund. In various cases, however, cash disbursement or other ways of using the amount are possible. For instance, the entire BVG credit balance can be paid out in cash if you definitively relocate to another country (except for EU and EFTA countries). Other popular options include advance withdrawal or pledging of the BVG retirement assets to purchase or build a home of your own, or to start out in self-employment. An advance withdrawal of the accrued BVG capital usually gives rise to substantial pension gaps, because the capital to pay out the BVG pension in old age is no longer available. Various products and solutions for private retirement provision are available to address this situation: examples include paying into a Pillar 3a product such as life insurance.

Financing occupational benefits insurance

Like individual retirement accounts, mandatory occupational benefits insurance (OPA) is also fully funded. Each insured person individually saves up for retirement through a legally regulated saving process. As pension funds are required to guarantee all current and future pension payments over the long term, the OPA deductions that are continually paid in are invested as securely as possible, but with the objective of earning returns. The capital market is thus regarded as the "secret" third contributor alongside employers and employees.

Frequently asked questions

Who is insured under Pillar 2, and who has to pay contributions?

All employees with a specified annual salary subject to AHV (above the minimum annual salary for BVG purposes) are insured in Pillar 2, or mandatory occupational benefits insurance (BVG) and, at the same time, they are also obliged to pay contributions. Persons not in gainful employment should build up private pension provision and invest in products such as a Pillar 3a account or life insurance.

Who is responsible for BVG coverage?

Employers are tasked with proper organization and calculating occupational benefits insurance. They then choose a pension fund or an occupational benefits institution and match the OPA deductions of their employees (generally up to 50% for each employee).

When is the BVG capital paid out?

The OPA retirement savings are generally paid out in the form of a monthly pension when the employee reaches the reference age (formerly: normal retirement age) of 65. Anyone who permanently relocates abroad, starts out in self-employment or purchases residential property has the option of withdrawing their accumulated retirement savings.

How much is the maximum monthly pension?

There is no maximum limit for the amount of the retirement benefit paid out by the pension fund. The payment amount is based on the available retirement assets or capital and on the applicable conversion rate. For instance, with retirement assets of CHF 115,000 and a conversion rate of 6.8%, the retirement income will be CHF 7,820.

How is occupational benefits insurance financed?

Unlike the AHV/DI pensions, which are financed on a pay-as-you-go basis, the funding of occupational benefits insurance is capital-based. Capital for retirement provision is accrued for each individual, within a defined legal framework. To ensure that the BVG pensions are also secured in the long term, the money paid into the BVG is invested on the capital markets with the objective of earning returns, but nevertheless securely.

Always there for you

Do you have any questions, or would you like a pension consultation? We are always there for you!

The Swiss three-pillar system

The three-pillar system: a simple explanation

The purpose of the Swiss pension system with its three pillars is to ensure financial security for people in Switzerland in their old age, in the event of disability and in death cases.

Pillar 1 – AHV/DI/EO

The purpose of the first pillar is to secure people’s livelihood in old age, in case of disability (including occupational disability) or following a death.

Pillar 3 – private pension provision

By making voluntary payments into tied pension provision (Pillar 3a) or flexible pension provision (Pillar 3b), you can close income gaps from Pillars 1 and 2 of the Swiss social system to the fullest extent possible.