Pillar 3

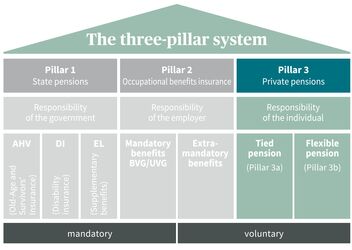

Private pension provisionPillar 3 of the Swiss three-pillar social system is a voluntary and flexible addition to mandatory pension provision through Pillars 1 and 2.

Pillar 3 aims to close any pension gaps that are not covered by the AHV/DI and BVG pensions. It should also enable you to meet your individual wishes for a fulfilling life after you retire. Pillar 3 private pension planning is growing in popularity. Private pension planning under Pillar 3 is growing in popularity. Demographic and social developments in Switzerland have made it essential so that people can continue their accustomed lifestyle in old age.

What is the structure of Pillar 3?

Pillar 3 is divided into tied pension provision (Pillar 3a) and flexible pension provision (Pillar 3b). Payments into 3a pension provision can be deducted from taxable income, whereas 3b flexible pension provision is only tax-privileged subject to certain conditions.

Tied pension provision (Pillar 3a)

Tied pension provision (Pillar 3a) is long-term pension provision; as its name suggests, the capital remains “tied” for private retirement provision. Advance withdrawals are only possible subject to certain conditions; on the other hand, savings on tax are possible by paying in contributions up to a specified maximum amount.

Pillar 3a tied pension solutions are often integrated as components of financial products such as life insurance, pension accounts or pension custody accounts. If you want to build up solid private retirement provision and achieve savings goals for the period after you retire, you will find many appropriate solutions within the scope of Pillar 3a that will give you security in old age.

Saving on taxes with Pillar 3a

There are various possible ways of saving on tax with a Pillar 3a solution. For example, contributions to Pillar 3a tied pension provision can be deducted from taxable income up to a specified maximum amount (you can find more information on the threshold amounts for Pillar 3 here). However, there are also many other ways of saving on tax with Pillar 3a. For instance, earnings (interest and surpluses) are exempt from income tax during the term, and advance lump sum payments are taxed at a specially reduced rate. Another advantage is that accrued pension capital is not liable for wealth tax.

Availability and disbursement

As a general rule, the money paid into a Pillar 3a restricted retirement plan can be paid out at the earliest five years before you reach the statutory OASI reference age (formerly: normal retirement age) of 65 for both men and women. The reference age will be gradually raised by three months each year for women in the transitional age group (born between 1961 and 1963) until the new reference age is reached.

Flexible pension provision (Pillar 3b)

Pillar 3b flexible pension provision (also known as non-tied retirement provision) is a private pension solution that is a good way to close a pension gap, because the pension from the pension fund is often insufficient to continue the person’s accustomed lifestyle after retirement. It is not subject to government requirements regarding amounts paid in, availability or timing of disbursement. But what many people do not know is that tax savings are also possible with a 3b pension solution, subject to certain conditions.

Pillar 3b flexible pension products are often integrated as components of complete solutions, like life insurance policies, investment funds, accounts, securities, residential property, collections of valuable items, etc.

Saving tax with Pillar 3b

Flexible pension provision also offers attractive possibilities for saving on taxes. For example, tax exemption applies to periodically financed endowment life policies and single premiums, if certain conditions are met. Unlike retirement pensions disbursed from Pillar 3 capital, which are 100% taxable, pension payments from Pillar 3b flexible pension provision are only 40% taxable.

Availability and disbursement

Unlike Pillar 3a tied pension provision, which can only be paid out subject to certain conditions, no legal restrictions apply to disbursements from Pillar 3b flexible pension provision. It is only necessary to comply with the minimum contractual terms or the contract term as agreed.

A comparison of Pillars 3a and 3b

| Tied pension (Pillar 3a) | Flexible pension (Pillar 3b) | |

| Objective | To secure and plan private pension provision and savings for old age on a long-term basis | Individual pension provision and achievement of personal savings goals with a short-term, medium-term or long-term focus |

| Persons | Available to everyone in Switzerland who must pay AHV contributions | Available to everyone living in Switzerland |

| Savings on taxes |

|

|

| Payment of pensions and availability for withdrawal | Normally a maximum of five years before reaching the reference age (formerly: normal retirement age), after which they are paid out as a monthly annuity. Advance withdrawals are possible to finance your own home, if you relocate abroad, or if you become self-employed. |

There are basically no legal restrictions on the timing of the disbursement. However, individual contract provisions apply to the term of a specific Pillar 3b solution. |

| Forms of pension provision | Life insurance, pension policy (insurance companies), pension account (banks or banking foundations) | Life policies, investment funds, accounts, securities, residential property, collections of valuable items, etc. |

When should I give some thought to my private pension provision?

Nowadays, the pensions paid out under Pillar 1 – and often those under Pillar 2 – will often be insufficient to maintain your accustomed lifestyle in old age, or to fulfill your wishes after you retire. So the question that arises is not whether it makes sense to pay into private Pillar 3 pension provision, but when is the best time to do so. Read on to learn about specific points regarding Pillar 3 that you should be aware of in connection with various events in your life.

Self-employment

- Payments into Pillar 3a bring major tax advantages. A maximum of up to 20% of the AHV income can be deducted from taxable income. You can find more information on the threshold amounts for Pillar 3 here. Tax-privileged capital savings under Pillar 3a can be withdrawn in advance at a special low tax rate, so you can invest them in projects connected with a move to self-employment.

Divorce

- If no separation of property was agreed before the marriage, each marriage partner is entitled to half of the other spouse's pension capital saved during the marriage.

- Divorce can be a major incentive to take out a Pillar 3a solution – for example, to guarantee alimony payments in case of disability or death.

Family

- The birth of a child changes your pension requirements, not least due to the loss of earned income.

- By building up private pension provision in Pillar 3, you can help to close pension gaps in your family and partnership.

Residential property

- Capital paid into a Pillar 3a tied pension solution is a popular way of financing residential property. Depending on your needs and possibilities, the capital can be pledged or withdrawn in advance to finance your own home.

- An advance withdrawal of capital to finance residential property results in specific pension gaps that should be closed with suitable private pension products such as a pension policy / life insurance.

Frequently asked questions

How can I achieve my savings goals with Pillar 3a?

There are fundamental differences between the legal basis for pension accounts with banking foundations and pension policies from insurance companies. A wide variety of solutions and products are available in both these categories, enabling you to plan your private pension provision and ensure your security in old age.

How can I save on tax with Pillar 3?

There are many different ways of saving on tax with Pillar 3. For example, the contributions paid into Pillar 3a tied pension provision can be fully deducted from taxable income. But there are also some smart ways of reducing your tax burden with flexible pension provision under Pillar 3b.

Can I use shares to save for my retirement?

Many private pension solutions such as life insurance and Pillar 3a solutions include modules with return-oriented investments in the financial and equity markets. Nowadays, such modules are virtually irreplaceable elements of private pension planning.

Who can open a Pillar 3a or 3b?

Tied pension provision (Pillar 3a) is basically open to all employed persons in Switzerland who are obliged to pay AHV contributions; flexible pension provision (Pillar 3b) is generally available to everyone living in Switzerland.

How can I protect myself against the consequences of an illness?

The mandatory daily sickness benefits insurance organized by your employer only provides very limited protection against cases where income is lost due to an illness. If employees build up their private pension provision, the private pension product will often cover the risk of occupational disability as well.

Always there for you

Do you have any questions, or would you like a pension consultation? We are always there for you!

The Swiss three-pillar system

The three-pillar system: a simple explanation

The purpose of the Swiss pension system with its three pillars is to ensure financial security for people in Switzerland in their old age, in the event of disability and in death cases.

Pillar 1 – AHV/DI/EO

The purpose of the first pillar is to secure people’s livelihood in old age, in case of disability (including occupational disability) or following a death.

Pillar 2 – occupational benefits insurance

The second pillar includes occupational benefits insurance, occupational accident insurance, daily sickness benefits insurance and the vested benefits institutions. The second pillar aims to enable people to maintain their accustomed standard of living after retirement.