Easily calculate your premium online Car insurance

Telephone consultation on car insurance: 052 244 86 00

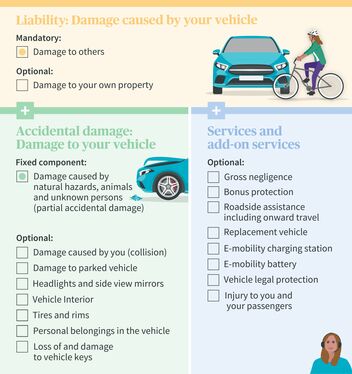

Which coverages should you buy for your car? At AXA, you can choose what you want to insure, and what you don't. Start with liability and accidental damage (partial or comprehensive accidental damage) and add on any other coverages that suit your needs.

Calculate your car insurance premium now and buy a policy with just a few clicks:

Car liability insurance is mandatory under Swiss law and must be concluded before you can register your vehicle. It covers damage that you as the driver cause to people, animals or property.

You can also choose to insure damage caused to your own property. This add-on policy also covers the costs of a collision with your second car or your garage door.

Personalized coverage to fit your needs: You only insure what you actually need.

Top benefits from the top company: No one else offers more comprehensive protection than we do.

Zero worries if you have an accident: Just reach out to us – we’ll take care of everything.

The insurance excludes damage or traffic accidents that are caused by you as the driver

Nor is operating damage to the vehicle, such as wear and tear, covered.

When driving abroad, the international insurance card (formerly known as the green insurance card) confirms that you have liability insurance for your own car. You can order one online. It isn’t needed in countries bordering Switzerland.

Parking damage occurs when you discover that your parked car has been damaged and the person who caused it cannot be found. This policy can be added to your car insurance.

If you damage your car while parking, it is covered under comprehensive accidental damage because it is not considered to be parking damage. This damage is insured through comprehensive accidental damage insurance.

No. If it’s just a minor accident, all you need to do is fill out an accident report. However, if it’s not clear who was at fault, it’s always advisable to call the police. If someone is injured, the law requires that you inform the police.

If you hit an animal with your car, you must inform the police or the local game warden immediately.

What do I need to do if my car breaks down abroad? Our expert Guido Binder, Head of 24-hour Customer Service, provides answers to the most important questions.

If you switch cars or buy a new car, you have to insure it by law. But which car insurance is the best? Our blog compares partial and comprehensive accidental damage insurance side by side.

Do you know what to do if you are involved in a road accident? Our checklist contains all the important steps – in the right order.