Key points at a glance

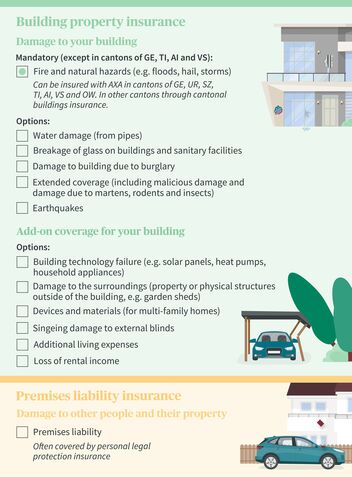

- Comprehensive coverage for your building: Building insurance protects you against the financial consequences of loss due to fire, natural hazards (such as floods or storms), water (e.g. from pipes), glass breakage or as a result of a burglary.

- Select just the coverage you need: Every building is different. This is why you can choose just the add-ons you want for damage to the building’s surroundings, structural installations, equipment, materials and more. We’ll be happy to advise you.

- Photovoltaics, solar power systems & heat pumps: Our comprehensive coverage for building technology insures systems that use renewable energies. In addition to damage and destruction, you can also insure loss of earnings due to lost power generation.

Examples of damage/loss

Support and frequently asked questions

Is earthquake damage covered by building property insurance?

No, most buildings in Switzerland are either not covered or insufficiently covered against the consequences of earthquakes. With our supplementary insurance, "earthquake insurance," you can insure your building against this risk.

Must I have building insurance against fire and damage from natural forces?

In most cantons, house owners are required to take out building insurance against fire and damage from natural forces. The cantons of Geneva, Ticino, Appenzell Innerrhoden and Valais are exceptions to this rule – there you can insure yourself voluntarily. You can only freely choose your coverage in the following cantons:

- Geneva

- Uri

- Schwyz

- Obwalden

- Ticino

- Appenzell Innerrhoden

- Valais

In the remaining 19 cantons, you are required to take out the corresponding cantonal building insurance.

For minor conversions to my own home, do I need to take out separate construction insurance?

No, loss/damage from minor renovations and repairs up to a construction amount of CHF 100,000 are covered by AXA’s building property insurance.

Can I insure my heat pump or solar energy system against damage?

Yes, with our supplementary insurance, "Building technology failure," you can insure the technical systems of your building against destruction and damage.