The three-pillar system: a simple explanation

Building up pension provision in SwitzerlandThe purpose of the Swiss pension system with its three pillars is to ensure financial security for people in Switzerland in their old age, in the event of disability and in death cases. Our pension model is one of the most reliable in the world. It has proven its merits over many decades, and it dates back to the establishment of Old-Age and Survivors' Insurance (AHV), Disability Insurance (IV/DI) and Loss of Earnings Benefits (EO) in 1948.

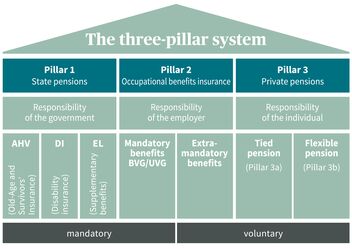

The three-pillar system has been enshrined in the Federal Swiss constitution since 1972. It is based on the interaction between state protection of basic livelihood, occupational benefits insurance (which includes employers), and tax-privileged private pension provision. The Swiss pension system is a key supportive factor in the social and financial security of people living in Switzerland.

What is the structure of the Swiss three-pillar pension system?

Switzerland’s pension system consists of three pillars: state, occupational and private pension provision. The purpose of Pillar 1 – old-age, survivors' and disability insurance, or AHV – is to secure livelihood. Pillar 2 – occupational benefits insurance, or BVG – is intended to maintain the accustomed standard of living in old age. Both Pillar 1 and Pillar 2 are mandatory.

Pillar 3, which is voluntary, enables you to build up private pension provision so that you can be secure in old age, but it also allows you to save on taxes and insure risks such as death cases and occupational disability.

Pillar 1 – Securing your livelihood with state pension provision

Pillar 1 comprises old-age and survivors' insurance, disability insurance (AHV/DI), and also supplementary benefits under loss-of-income insurance (EL). AHV/DI provides coverage to secure the livelihood of insured persons in old age, in a death case, or in the event of disability. The purpose of supplementary benefits is to secure livelihood if other state security benefits or your own income are not sufficient. As a general rule, all people working and living in Switzerland are covered by Pillar 1 of the pension system. You can learn more about Pillar 1 here.

Pillar 1 at a glance:

- AHV, DI, EO

- Mandatory state pension provision

- Objective: to secure the livelihood of all people living and working in Switzerland

Pillar 2 – occupational benefits insurance

Pillar 2 of the Swiss pension system consists of occupational benefits insurance (BVG), also commonly referred to as the "pension fund". The purpose of occupational benefits insurance is to supplement the benefits from AHV/DI in old age, in the event of disability and in a death case, and to ensure that your accustomed lifestyle can be maintained. All employees with income above the annual salary subject to AHV contributions (minimum annual BVG salary) are insured by the pension fund chosen by their employer, and through the automatic BVG deductions. Like the insurance coverage under Pillar 1, occupational benefits insurance is therefore part of mandatory pension insurance. The second pillar also includes occupational accident insurance, daily sickness benefits insurance and the vested benefits institutions. You can learn more about Pillar 2 here.

Pillar 2 at a glance:

- Occupational benefits insurance (BVG) or "pension fund", accident insurance, daily sickness benefits insurance, vested benefits institutions

- Additional mandatory pension provision for working people

- Objective: to maintain your accustomed lifestyle

Pillar 3 – voluntary private pension provision

The third pillar (comprising Pillar 3a and Pillar 3b) is a voluntary addition to the benefits from AHV/DI and occupational benefits insurance. Nowadays, benefits from Pillars 1 and 2 will often be insufficient to maintain a person’s accustomed lifestyle in old age. For this reason, many people in Switzerland opt for additional private pension provision based on Pillar 3, in order to avoid unpleasant income gaps. The third pillar consists of tied pension provision (Pillar 3a) and flexible pension provision (Pillar 3b). Contributions to 3a tied pension provision are tax-privileged and can be deducted from taxable income, up to a defined maximum. You can find out more about Pillar 3 here.

At a glance:

- Voluntary private pension provision

- Tied pension provision 3a (tax-privileged) and flexible pension provision 3b

- Objective: to maintain your accustomed lifestyle and fulfill your individual wishes in retirement

Frequently asked questions

How can I achieve my savings goals for retirement?

Pillars 1 and 2 of the Swiss social system secure the minimum financial requirements in the period following retirement. If you intend to pursue additional savings goals for your old age and you want to exclude income gaps as far as possible, you should opt at an early stage for a pension solution based on Pillar 3a tied pension provision or Pillar 3b flexible pension provision. AXA offers a variety of attractive solutions for these purposes.

How can I protect myself in case of unemployment?

In addition to old-age and survivors' insurance (AHV), disability insurance (IV/DI – which protects employees in case of disability – and supplementary benefits under loss-of-income Insurance (EL), Pillar 1 also includes state unemployment insurance (ALV). This covers employees against unemployment. There are also private options that offer protection against unemployment and financial solutions in the worst-case scenario. Self-employed persons in particular are well advised to take out a suitable pension solution for this purpose.

What is a pension gap?

In order to maintain your accustomed standard of living after retirement, you should have about 80% of your last gross salary available to you. A “pension gap” is the term used if the amount paid out per month in retirement is below this figure. If you want to give yourself additional security in old age, you can take out pension products that serve this purpose.

Always there for you

Do you have any questions, or would you like a pension consultation? We are always there for you!

The Swiss three-pillar system

Find out more.

Pillar 1 – state old-age pension/disability pension/earnings compensation

The purpose of Pillar 1 is to secure livelihood in retirement, in the event of disability and incapacity to work, or after a death.

Pillar 2 – occupational pension

Pillar 2 includes occupational pensions, occupational accident insurance, daily sickness benefits insurance, and the vested benefits institutions. It's intended to enable people to maintain the standard of living they're accustomed to after retirement.

Pillar 3 – private pension

By making voluntary payments into a tied (Pillar 3a) or flexible (Pillar 3b) pension, you can close any income gaps from Pillars 1 and 2 of the Swiss pension system to the fullest extent possible.