Key points at a glance

- Secure income: with occupational disability insurance, you avoid income gaps if you can no longer work due to health reasons.

- Special protection for the self-employed: this insurance protects you as a self-employed individual against major loss of earnings due to accident or illness.

- Regular payments: if you are unable to work again in the long term, you will receive regular payments in addition to other pension benefits.

Secure income in the event of occupational disability

Would you like to be able to count on your usual income, even in the event of occupational disability? If you can no longer work for a certain period of time or permanently, you will receive regular payments in addition to other pension benefits.

The advantages of the occupational disability pension

- Adaptable to effective needs on a customized basis

- Flexible contract structure

- Pensions already start with occupational disability of 25%

- Can be combined with your retirement provision

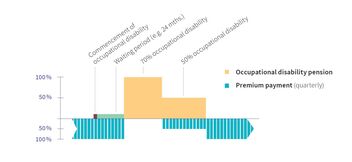

- As long as you draw an occupational disability pension, you are exempt from paying premiums

Pension protection with the occupational disability pension

Frequently asked questions

Who is at particular risk of income gaps due to occupational disability?

Those who are not affiliated to a pension fund are at particular risk of pension gaps upon occupational disability, i.e. students, the self-employed or stay-at-home mothers or fathers. But even those who have made early withdrawals from occupational pension to fund home ownership can also be affected by income gaps.

Can I save on tax with the occupational disability pension?

You have the option of deducting the paid annual premium in accordance with the legal limit from your taxable income. This way you reduce your annual tax burden.

Do my family members also receive money in the event of my death?

No. But you have the option of taking out term life insurance as supplementary insurance for the occupational disability pension.

What is a waiting period and what are the conditions?

The waiting period is the period between the commencement of occupational disability until the first pension payment is disbursed. You can choose between a three, six, twelve or 24-month waiting period.

Always there for you

Do you have any questions, or would you like a no-obligation pension consultation? Our experts are there for you.

Further information for your protection

Is your family financially well protected?

Do I still have the right insurance cover? What happens if a parent is incapacitated? Every family has its own needs – and needs the appropriate insurance coverage.

Rega or ambulance: who pays?

Emergency transportation is expensive. Many people are surprised at how much they have to pay themselves – even though they have health insurance.

Save tax with Pillar 3

Families have plenty of expenses. Pillar 3 offers you a simple way of saving while protecting your loved ones at the same time.