Bad weather warning: 6 expert tips for storms and floods

Heavy thunderstorms, hail and storms are causing major damage more frequently in Switzerland. We explain what you have to do if you suffer a loss event and which insurance policy pays for what kind of damage. Read our expert tips about these issues which are aimed at tenants, homeowners and businesses.

1. Anticipate bad weather - stay informed

If a storm is brewing, it's advisable in the first instance to find more information about it. If the weather situation is unstable, media or apps with push messages give warnings quickly and precisely about storms, hail and heavy rain and/or thunderstorms.

- Alertswiss: this is the official app used by the Federal government to directly issue alarms, warnings and information on various dangers using push notifications

- Weather-Alarm (only in German): Weather app with up-to-date push weather warnings and via 222 live cams

- MeteoSwiss: All weather-related news from the Swiss Federal Office of Meteorology and Climatology – including hazard maps, warnings as well as pollen forecasts and UV index

- Natural hazards: Here the government provides information about natural hazards and gives advice

- PLANAT (only in German): The national platform for further information on “Natural hazards”

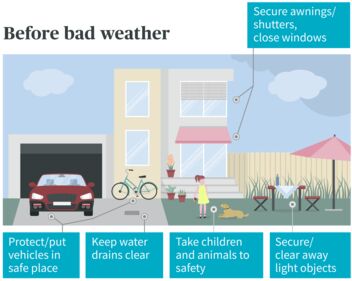

2. The most important tips for your home

If a storm is brewing, warnings and advice are given in the media. Those who follow them protect themselves and others. Here are the most important rules to follow:

If there is a risk that water could enter the building in a storm or during persistent heavy rain, store valuable items in a safe place or higher up. If the flood has already occurred, do not enter the affected rooms and areas, as this could be life-threatening.

3. What do I do in the event of damage/loss?

- As a rule: save, dry and clean damaged property

These measures help prevent the damage from spreading. If perishable goods or low-value items are affected, they can be disposed of. - Make a list of damaged items and take photos too. Expensive items should be kept available so that they can be inspected by experts if need be.

- Keep a note of the cost of your cleaning and disposal work, as this is also compensated. AXA provides a bad weather page where you can download useful forms.

4. Which insurance policy pays?

If damage is caused by natural forces, such as high water, hail or flooding, then depending on the items affected, different types of insurance policies are responsible.

- Furniture and installations: private household contents insurance or corporate property insurance – Cantonal insurance is responsible in the cantons of Nidwalden and Vaud.

Note: If a business has to be temporarily closed after storms or flooding, an insurance policy for “business interruption” can be existential for the continuation of a business. - Damage to vehicles: partial accidental damage of private car insurance or fleet insurance for companies.

- Damage to buildings, such as roof blown off: buildings insurance for private individuals or buildings insurance for companies – In most cantons, cantonal buildings insurance is liable for damage caused by natural forces.

- The "Damage to the surroundings" offer in the "Damage to buildings" module protects you against the financial consequences of damage around your building, for example, to paths, garden fences or steps.

GUSTAVO cantons: Geneva, Uri, Schwyz, Ticino, Appenzell Innerrhoden, Valais, Obwalden

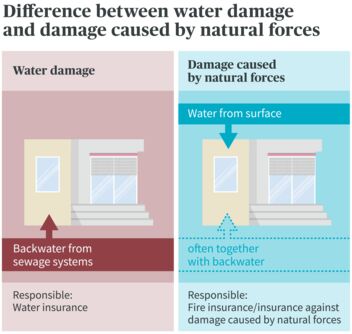

What is damage caused by natural forces, what is water damage?

Insurance against damage caused by natural forces: Globally unique system

A natural event is essentially an unpredictable natural force that hits people and property with irresistible and sudden force. Nobody can be made responsible for this type of event.

In Switzerland, damage caused by natural forces, i.e. storm, hail, avalanche, snow loads, rock avalanches, landslides, falling rocks, flooding and floods, is closely linked to fire insurance. As nearly all buildings and contents are insured against fire, the insurance companies integrated automatic fire insurance against damage caused by natural forces. Due to this “enforced” solidarity, natural hazards which can vary a great deal regionally can be insured for a reasonable and standard price. The risk is distributed among more insured parties. This globally unique system has been shown to work. Without this solidarity, it would, for example, be almost impossible to insure against avalanche risk in a mountainous region.

Water damage: Water is not just water

From an actuarial perspective, the decisive factor in the event of flood or flooding is whether the damage was caused by natural forces or by water damage. This question has often led to differences about liability between insurers which is an extremely unpleasant situation for all those who are directly affected by any damage. An agreement has been in place for several years governing which insurance policy is liable and when in terms of buildings or furniture and installations. In general:

- Water damage: private insurance companies

- Damage to buildings caused by natural forces: in most cases the cantonal buildings insurers

By contrast, furniture and installations are normally covered by private insurers.

It therefore depends where the water came from.

5. It’s best to file an insurance claim online

If there have been major storms, we advise you to file claims online. The next steps will be decided depending on the situation: Cars that are no longer roadworthy are moved to a collection point for assessment. A claim adjuster visits the site whenever there is major damage to property and buildings. Many of the claims are dealt with by our staff from their office. The clearer the case is based on the documentation - i.e. lists and photos - the quicker it will be settled.

6. Damage to car or van? Help is provided quickly at the drive-in

Hailstorms can cause immense damage, particularly to motor vehicles. AXA organizes a local drive-in whenever large hail events pass through. After booking a time slot, here is where you can quickly and easily stop by with your car or van to get an instant repair estimate.

"Storm and hail damage: cars, vans, motorcycles, etc." is where you can find more information on what you should do if your motor vehicle suffers storm damage.