Key points at a glance

- Make financial provision: with AXA’s SmartFlex pension plan (Pillars 3a/3b), you build capital for the time after retirement and save on taxes at the same time.

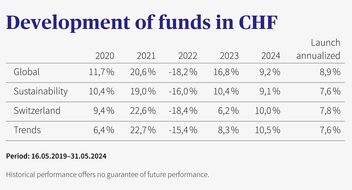

- Flexibly adaptable: choose from four investment topics - Sustainability, Switzerland, Future Trends and Global - and adjust your strategy where necessary.

- Attractive returns: in line with your risk tolerance, you can divide your money into security capital and return-oriented capital, and thus achieve attractive returns.

Arrange an appointment: 052 269 21 67

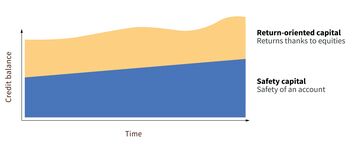

Flexible premium split

With your personal premium split, you determine which portion of your premium should be invested in equities as return-oriented capital, and which portion earns interest as safety capital and is legally secured in full.

You can individually amend your premium split and decide at any time how your assets should be invested or how much you would like to benefit from the possibility of generating returns.

Safety options

Would you like to help manage the risk of your investment? Choose our safety options and activate and deactivate them at no cost whenever you like.

- Protection of earnings

Protect the investment income (distributions from your equity fund) and surpluses from your contract. Your income will be allocated to the safety capital. - Maturity management

You have the option of reducing your investment risk gradually before the contract ends by progressively reallocating the return-oriented capital into your safety capital portion that earns interest at variable rates. - Activate and deactivate safety options

The SmartFlex safety options can be activated and deactivated at no cost and at any time during the contract. - Manual reallocations

You can make manual reallocations at any time between the return-oriented capital and the safety capital portion that earns interest at variable rates. This enables you to help manage the risk of your investment.

Integrated term life insurance

Did you know that the SmartFlex pension plan includes optional comprehensive term life insurance?

You can choose from the following options:

- Guaranteed lump-sum death benefit.

- Reimbursement of premiums already paid into the pension plan +10%, with supplementary insurance for premium waiver in the event of occupational disability in Pillar 3b.

- Without term life insurance, but with supplementary insurance for premium waiver in the event of occupational disability.

The amount of the guaranteed death lump sum can be adjusted. This may require a new review of professional, personal and health circumstances.

Frequently asked questions

Which is better? Pension provision with a bank or insurance company?

A pension solution with a bank or insurance company does not have all advantages or disadvantages. But in a detailed comparison of both alternatives, it becomes clear that a Pillar 3a pension solution with an insurance company has many more options and flexibility than a pension account with a bank.

How safe is my saved capital?

You benefit from AXA’s experience as one of the world’s largest asset managers. We are particularly known for our expertise in managing pension assets. Your contributions in your safety capital have full legal protection in AXA’s tied assets. The capital in your return-oriented capital also has legal protection to the extent of the current market value.

How flexible can I make provision with the SmartFlex pension plan?

The SmartFlex pension plan can be flexibly adapted to your personal financial circumstances and requirements. Save for your life in retirement in a way that suits you today! You benefit from various safety options and can also easily reallocate capital from the safety capital into the return-oriented capital. You also have the option of varying from the fixed pension premium or stopping individual payments entirely.

Always there for you

Do you have any questions about Pillar 3 or would you like a no-obligation pension consultation? Our experts are there for you.

Further information to help you plan your financial future

Save tax with Pillar 3

Families have plenty of expenses. Pillar 3 offers you a simple way of saving while protecting your loved ones at the same time.

Pension provision from a bank or insurance company

When choosing a suitable provider for a pension solution based on Pillar 3a, interested parties are quickly faced with the question of whether to choose a bank or an insurance company.

Pension fund certificate in a nutshell

At first glance, the pension fund certificate is a mass of technical jargon and figures. But it's not that hard to make sense of it.