Key points at a glance

- Predictable income: You finance regular payouts with a one-time deposit. You define the amount and period of the payouts.

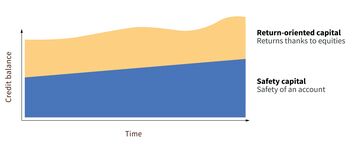

- Attractive returns: In line with your risk tolerance, you can divide your money into safety capital and return-oriented capital, and thus achieve attractive returns.

- Free safety options: Upon request, you can benefit from investment management, income levelling, and income protection.

Arrange an appointment: 052 269 21 67

How the SmartFlex income plan works

Individual investment split

With your personal investment split, you decide how your deposit is divided: Part of it goes into interest-bearing safety capital. The other part is invested as return-oriented capital – with the chance of higher returns, but also the risk of value fluctuations. You have the option of reallocating your capital during the term of the contract.

Free safety options

Would you like to actively manage your investment risk? Take advantage of our flexible safety options, which you can customize at any time to suit your needs. Exception: Investment management can only be activated at the start. All safety options can be selected independently of each other.

- Investment management: Staggered investment of your payment helps reduce the risk of unfavorable investment timing.

- Income smoothing: To reduce fluctuations in the payouts, your return-oriented capital is reallocated to safety capital on a staggered basis.

- Income protection (airbag): In the event of highly negative market developments, the entire return-oriented capital will automatically be reallocated to the safety capital. This enables further losses in the return-oriented capital to be avoided. On request, investments can be reallocated at any time after that.

Frequently asked questions

Why is AXA able to offer such an attractive preferential interest rate?

As an insurance company, AXA can invest funds tied to customer contracts on a long-term basis: Pension products often have terms of several decades. This predictability makes it possible to offer attractive interest rates while maintaining a high level of security.

What advantages does AXA have over a bank or pension fund?

The SmartFlex income plan offers advantages in terms of predictability, interest rates, and security, complemented by optional safety features (free of charge).

SmartFlex vs. bank:

- Unlimited deposit protection – no upper limit as with banks

- Fixed preferential interest rate on safety capital – no risk of negative interest rates

- Safety options for easy management of investment risk – hardly any banks offer this

SmartFlex vs. pension fund:

- Inheritance of remaining capital – no forfeiture as is sometimes the case with pension funds

- Individual and flexible payouts – not fixed as with a pension fund

- Access to existing capital possible – not blocked as with a pension fund

Depending on your situation, other advantages may of course outweigh these, such as a guaranteed pension for life (pension fund) or the ability to withdraw your capital quickly and easily (bank). But be careful: Depending on interest rate increases, early withdrawal can lead to losses.

Is there a minimum amount for the SmartFlex income plan?

Yes, you can participate with a one-time deposit of CHF 15,000 or more. The contract term is 10 to 30 years, with the option of early termination.

What will happen to my money if AXA goes bankrupt?

With SmartFlex, you benefit from comprehensive deposit protection. In the event of bankruptcy, deposits held as safety capital are 100% protected by law. By way of comparison: Bank deposits are subject to an upper limit of CHF 100,000 per customer – any amount above this is not protected.

Deposits in return-oriented capital would also not be affected by bankruptcy. They are legally protected up to the current market value of the shares.

What are the costs associated with the SmartFlex income plan?

The costs are relatively low:

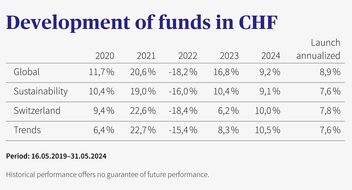

- Fund costs: Between 0.16% and 0.39%, depending on the investment theme (as of July 2025)

- No issue or redemption fees

- Total costs: Individual, depending on the contract configuration – clearly stated in your personal offer

Always there for you

Do you have questions about Pillar 3 or would you like a no-obligation pension consultation? Our experts are there for you.

Further information to help you plan your financial future

Save on taxes with Pillar 3

Families have plenty of expenses. With Pillar 3, you can easily save money and protect your loved ones at the same time.

Bank or insurance company?

When choosing a suitable provider for a pension solution based on Pillar 3a, interested parties are quickly faced with the question of whether to choose a bank or an insurance company.

Pension fund certificate in a nutshell.

At first glance, your pension fund certificate may seem like an incomprehensible jumble of technical terms and numbers. But when you know what you’re looking at, it’s actually pretty straightforward.