The four rules for saving with shares

Broad diversification

Those who invest smartly spread their capital between different individual shares and regions to avoid cluster risk. Those who invest in AXA’s SmartFlex pension plan, for example, will be cleverly building up their retirement provision and avoiding a pension gap. The investment funds are strongly diversified and investors can choose from four different investment themes.

Long-term investment horizon

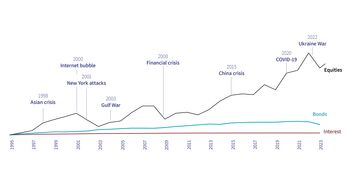

All good things are worth waiting for. Surprisingly, this maxim also applies to saving with shares. Keeping calm and thinking for the long-term is usually the best policy. This is because the long-term perspective on market trends of the Swiss Performance Index, for example, over the last 25 years shows that despite crises, equity investments fare much better than savings accounts or bonds in terms of appreciation.

Note the low investment costs

Those who also wish to invest in shares to achieve their savings goals should take a close look at the costs involved. Excessively high costs lead to a substantially lower return. The total cost of an investment consists of the cost of fund management, fund administration and fees for buying and selling fund units. The SmartFlex pension plan which involves investing part of savings capital in equity investments is characterized by comparatively low investment costs.

Regular payments

The general principle for long-term saving is that regular payments and consistent savings discipline are the nuts and bolts for sustainable and continuous capital accumulation. But regular contributions into a return-oriented pension plan also make sense with a view to investing on the stock market. Because those who contribute regularly benefit from being able to buy when prices are low when share prices fall. Here the experts also talk about the average price method in this regard.