Which regions are most affected by storms?

The current wave of extreme weather is causing a large number of claims. AXA registered storm damage claims totaling CHF 132 million last year, which is in line with the long-term average. However, some regions stand out in the statistics: hail damage to cars, accounting for the largest share of storm-related claims, was most common in the cantons of Ticino, Jura, and Neuchâtel over the past 20 years.

Switzerland has experienced storms almost on a daily basis this week, so the season is well and truly under way for 2025. It normally lasts until September, although there is a lot of uncertainty. The number and size of claims varies significantly from year to year, as the figures published by AXA – Switzerland's biggest property insurer – show. In terms of storms, 2024 was an average year, with AXA recording claims totaling CHF 132 million for damage to vehicles, buildings, and household contents as well as fixtures and fittings. This is a similar amount to 2022 (CHF 143 million) and around half as much as in 2021 (CHF 292 million) and 2023 (CHF 239 million), but roughly twice as much as in 2019 (CHF 73 million) and 2020 (CHF 61 million). "The differences are considerable and have a huge impact on our claims figures, but weather risks and their volatility over time across the different regions are part of our core business and thus factored into our long-term planning," says Stefan Müller, Head of Property Claims at AXA.

Including motor vehicle, household contents, corporate property, watercraft, and engineering insurance

Storms occurring more suddenly and with increasing intensity

AXA's figures show an increase in storm damage claims over the past four years. "It would be too soon to call this a trend, but we know from experience that storms have been happening more suddenly than they used to in recent years and have become much more intense: extreme gusts of wind, more heavy rainfall, often large hailstones – all of this sometimes highly localized," says Stefan Müller. This is only partially reflected in the flood damage statistics, since the Confederation, the cantons, and the communes have also been spending more on protective measures. Flood relief tunnels, retention basins, raised dams, and the national flood risk map are all paying off.

Hail damage a key factor

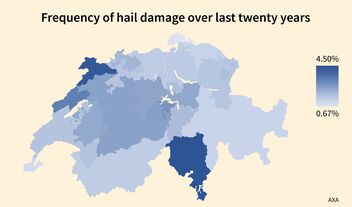

Not all regions of Switzerland are exposed to the same risks. AXA's claims statistics paint a clear picture of where the various kinds of damage occurred most often. Hail damage to cars makes up the largest share of storm damage claims in terms of both number and cost. The cantons of Ticino, Jura, and Neuchâtel, together with Nidwalden, Obwalden, Bern, Lucerne, Schwyz, and Fribourg, were most affected over the past 20 years. "Major hail events in particular, which can damage a huge number of cars within a short time frame, are a key factor with regard to the number of claims," says Patrick Villiger, Head of Motor Vehicle Claims at AXA. Schaffhausen, Geneva, Graubünden, Glarus, and Thurgau, meanwhile, recorded hardly any hail damage.

Including motor vehicle, household contents, corporate property, watercraft, and engineering insurance

Frequent flooding in Schwyz

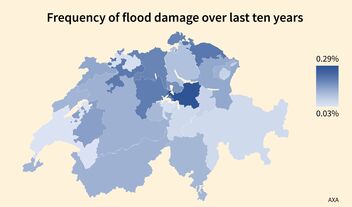

The highest incidence of flood damage claims per insured household occurred in the canton of Schwyz over the past ten years, followed by Thurgau, Solothurn, and Lucerne. It must be noted, however, that single flooding events pushed claims numbers up sharply in each case. The cantons of Vaud, Nidwalden, Basel-Land, Graubünden, and Uri remained mostly free from flooding over the past ten years.

Including motor vehicle, household contents, corporate property, watercraft, and engineering insurance

Lightning most common in Ticino

When it comes to lightning damage, one canton tops the list by a considerable margin: over the past ten years, the risk of damage due to lightning strikes in Ticino has been almost seven times higher than in the rest of Switzerland. AXA registers several hundred claims on household contents insurance in the canton every year. Compared with the cantons of Basel-Land, Vaud, and Geneva, the risk was in fact 26 times higher. It is not hard to understand why. When warm, humid air from the Mediterranean moves northward and hits the Alps, it forms storm clouds with strong upward and downward winds as well as high levels of electrical charge, which is discharged in the form of lightning.

Including motor vehicle, household contents, corporate property, watercraft, and engineering insurance

How to protect your property

If you take some precautions, you can minimize the risk of certain kinds of storm damage to your property. Apps are available that quickly send a push message whenever there is a weather warning in your location. If a storm with strong winds is on the way, you should make sure that movable items like grills and garden chairs are firmly secured or taken inside and retract your sunshades. If there is going to be heavy rain, you should also check that your drains are not blocked and close your windows. When there is a risk of water leaking into the building, you should place all valuables and anything susceptible to water damage somewhere high up. In the event of hail, vehicles should be brought under cover and shutters rolled up. Stefan Müller explains something many people fail to realize: “Hail can't really damage windows, but it can definitely damage shutters."

Insurance cover for storm damage

Storm damage can be covered by different forms of insurance, depending on what it affects. Furniture and fittings are covered on a new-for-old basis under household contents insurance. Partial accidental damage insurance, meanwhile, covers storm damage to vehicles. If the building itself is damaged, this is covered by building insurance, which is provided by a cantonal institution in most regions. "Fortunately, Switzerland has an outstanding system for natural hazard insurance that's regulated by law and unique in the world. It ensures standardized coverage and premiums across all private insurers in all regions and thus guarantees a very high level of protection in the event of storms," explains Stefan Müller.