How much does it cost to raise a child in Switzerland?

When you have a baby, taking time off work, buying all the new things baby needs and arranging childcare can really throw off your budget. But if parents-to-be take a good look at their finances early on, they can enjoy their new-found domestic bliss without having to make major financial sacrifices.

Raising children is expensive, which causes many prospective parents to worry. And of course having children is a huge responsibility. But monetary fears are often unfounded. The key is to keep a clear overview of your finances and carefully plan your monthly expenditures – and it’s best to start doing this before your little bundle of joy arrives.

So just how much do children cost?

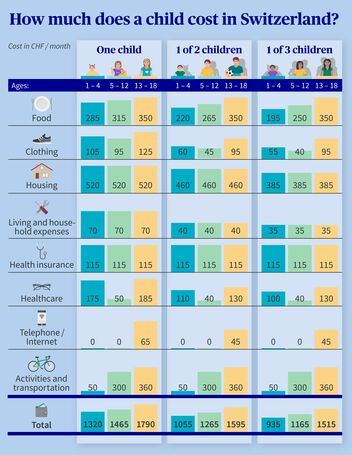

According to the Zurich Department of Child Welfare Services (in German), the monthly costs for a child range between CHF 1,390 and CHF 1,595, depending on the age of the child. This is the amount of money you’ll spend on food, clothing, household and living expenses, healthcare, entertainment and transportation.

Please note that this figure does not include external childcare. Nor does it account for indirect costs – specifically, your loss of income and the value of the unpaid work you do for your family. In a study conducted by the Federal Statistical Office some time ago, all these factors added up to an average total cost of around one million francs per child. That’s quite a bit of money.

Daycare, family care and preschool: childcare in Switzerland

It’s striking to see that, compared to other countries, parents in Switzerland pay a lot for childcare outside the home. Daycares and preschools generally cost between CHF 110 and 130 a day. These rates vary greatly depending on your canton and town. Depending on what they earn, parents are expected to cover between 30 and 100 percent of this amount. Families that enroll two or more children in the same childcare center receive a sibling discount. And the prices for home-based family daycares, which are often organized in associations, vary even more. Many daycare parents are paid a before-tax rate of about CHF 8 per hour. Meals, transportation expenses and entertainment are extra. You can find detailed information about family daycare at Verband Kinderbetreuung Schweiz (in German).

Can we even afford children?

This question is a common one when future parents are confronted with the dizzying figures of certain studies. It’s also a valid question, but at the end of the day perhaps not a very helpful one for making an actual decision. A better question is: “Do we want children?” If so, then the next question should be: “How are we going to make this happen?” There’s always a way. While many couples can maintain their standard of living, others have to cut back on their spending.

And there’s more good news: When you have two or more children, the monthly costs per child go down. This effect is greatest with little children, however. When they get older, it more or less disappears. But depending on the situation, adding one more child to the family could mean greater expenses because parents might need to buy a larger car, apartment or house.

Source: Department of Child Welfare and Career Services, Canton of Zurich

What age is the most expensive?

The chart clearly shows that although you will need to buy a lot of new things for your baby when it arrives, the first few years are relatively inexpensive. If your parents can care for your child, then your average monthly costs should be around CHF 1,300. New costs come along starting with primary school. Let’s assume that your child will want to learn the guitar or join a soccer club. Then don't forget outings, spending money and more expensive expectations regarding clothing and entertainment. Costs are still manageable at just under CHF 1,500 per month at this age. By the time they are teenagers, however, average costs amount to CHF 1,800 a month because they start to develop more expensive needs even though they're not yet earning any money themselves. So, as you can see, children cost more every year right up until their last year of high school.

How much money does a family really need?

The figures in the chart for Zurich serve as a general guide, but they should also be put into perspective. Countless parents make do with less than this every month simply because they have to. Every family budget is as unique as the people in the family. Parents need to be interested in one thing only, and that’s how they are going to bring their expenses in line with their budget. And even if certain fixed costs have to be included in every budget, there are various that help parents set aside some money. A clear household budget and consistent spending checks help parents maintain an overview. In addition, our pension brochure helps parents to plan for long-term financial security.

Keeping your expenses under control

Apps such as “BudgetCH” (in German) offer good advice on how to keep your budget under control: Just use your smartphone to record the purchases you make. And everyone in your family can use the same account.

How do children affect your retirement savings?

After the baby comes, most mothers cut their working hours at least temporarily in order to take care of their children and keep up with things at home. According to the Family section of the Federal Statistical Office, some 60% of 25 to 54-year-old women work part time nowadays. This stands in contrast to seven out of eight men who still work full time. Because part-time employees earn less, they contribute less to their savings in the 1st Pillar and the 2nd Pillar. They can expect to only receive the minimum OASI pension and a considerably lower pension from their retirement fund. This is not enough to maintain the standard of living they are used to. In other words, if you work part time and still want to be well prepared for retirement, then you need to be proactive. One good option is to pay into the voluntary3rd Pillar. Another advantage is that all deposits you make into your Pillar 3a account are tax deductible so you save on taxes.