Insure current no claims level Bonus protection for car insurance

Accident-free driving gradually lowers your car insurance premium based on the no claims discount system - until you reach just 30% of your basic premium. Bonus protection guarantees that you don’t lose the discount on your insurance premium if you have an accident.

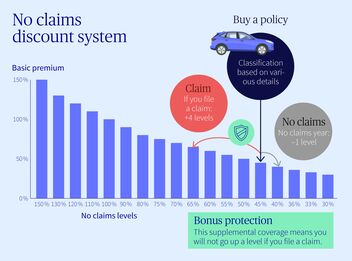

The basic premium for your car insurance is calculated based on various factors, such as the make and model of your vehicle and personal aspects like your age. This basic premium forms the basis for your insurance premium. It is then multiplied by your no claims level, also known as your premium level. This results in your actual car insurance premium.

The bonus or discount you receive depends on your no claims level. The lower your no claims level, the higher your bonus. Your no claims level is determined when your insurance goes into effect and is based on such things as your age and other personal information.

Call for a consultation: 052 244 86 12

If you don’t have any accidents while driving, AXA rewards you with a higher bonus and a lower no claims level (for liability, i.e. damage you cause to third parties, and collisions). Then the next year, you benefit from a higher no claims discount. Your no claims level goes down every accident-free insurance year until you reach the lowest level of 30 percent. At this level, you enjoy a 70 percent no claims discount and pay only 30 percent of your basic premium.

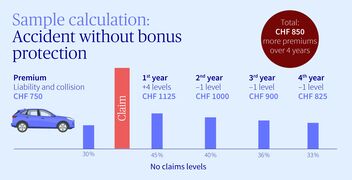

If you have an accident, you receive a malus. This means that your no claims level goes up – four levels for each accident – and you lose some of your no claims discount. When your no claims discount goes down, your premium goes up for the next premium period.

The bonus-malus system has nothing to do with the deductible you choose. Only after you file a claim do you pay the deductible. The amount of your deductible depends on what is defined in your policy for liability or partial or comprehensive accidental damage insurance.

Thanks to the Bonus protection add-on for your car insurance, you get to keep your current no claims discount even if you have an accident. This add-on policy prevents your no claims level from going up.

Bonus protection lets you keep your bonus level, or in other words, your no claims level for liability and comprehensive accidental coverage remains unchanged. Partial accidental damage claims do not impact your no claims level.

If you want to keep your current no claims discount even after you’ve had an accident, then bonus protection is worth it for you.

Yes. You are given a separate no claims level and no claims discount for your motor vehicle liability insurance and collision insurance, which will then be used to calculate each of the basic premiums. But the system itself is the same, so the levels that are used and the corresponding discounts are the same – both liability and collision insurance have a lowest level of 30 percent.

If you have not taken out bonus protection as an add-on policy for your car insurance, then your no claims level will go up after an accident. It will increase for whichever insurance must pay out benefits – either liability or collision. If no benefits are paid out for a reported claim or if the benefits that are paid out are refunded within 30 days, then the level remains unchanged. Partial accidental damage claims do not impact your no claims level.

It can if changes are made to the policy that change your premium.

One example of a basic premium adjustment is when you change vehicles or you file an excessive number of claims. Even if your basic premium changes, having bonus protection at the lowest level (30 percent) for example means that your premium won't increase as much because you can keep your no claims discount.

Top-quality service – Switzerland’s no. 1 car insurer

With the Safe Driver Bonus, all young drivers under 26 years of age enjoy a 15% premium discount

Excellent coverage even if you are at fault for the collision