With the SmartFlex pension plan (Pillar 3a/3b), you save individually and securely for the period after retirement. In doing so, you benefit from integral risk cover for death and occupational disability. Adapt your pension plan flexibly – to the present and future circumstances of your life.

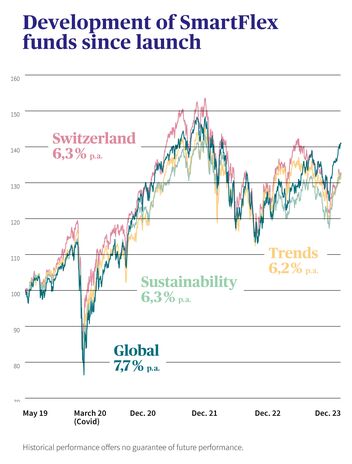

Under the SmartFlex pension plan, AXA invests your return-oriented capital in broadly diversified equity funds. As a customer, you have the option of choosing an investment that matches your personal convictions. You can choose between "Sustainability", "Switzerland", "Future trends" and "Global".

Around 3,000 companies globally (listed and unlisted, including subsidiaries) are excluded for all investment themes. These operate in sectors such as tobacco, armaments, coal, palm oil as well as oil or gas.

You can find out more here: ESG: definition and approaches.

With your personal premium split, you determine which portion of your premium should be invested in equities as return-oriented capital, and which portion earns interest as safety capital and is legally secured in full.

You can individually amend your premium split and decide at any time how your assets should be invested or how much you would like to benefit from the possibility of generating returns.

Would you like to help manage the risk of your investment? Choose our safety options and activate and deactivate them at no cost whenever you like.

Did you know that the SmartFlex pension plan includes optional comprehensive term life insurance?

You can choose from the following options:

The amount of the guaranteed death lump sum can be adjusted. This may require a new review of professional, personal and health circumstances.

A pension solution with a bank or insurance company does not have all advantages or disadvantages. But in a detailed comparison of both alternatives, it becomes clear that a Pillar 3a pension solution with an insurance company has many more options and flexibility than a pension account with a bank.

You benefit from AXA’s experience as one of the world’s largest asset managers. We are particularly known for our expertise in managing pension assets. Your contributions in your safety capital have full legal protection in AXA’s tied assets. The capital in your return-oriented capital also has legal protection to the extent of the current market value.

The SmartFlex pension plan can be flexibly adapted to your personal financial circumstances and requirements. Save for your life in retirement in a way that suits you today! You benefit from various safety options and can also easily reallocate capital from the safety capital into the return-oriented capital. You also have the option of varying from the fixed pension premium or stopping individual payments entirely.

Do you have any questions about Pillar 3 or would you like a no-obligation pension consultation? Our experts are there for you.

Families have plenty of expenses. Pillar 3 offers you a simple way of saving while protecting your loved ones at the same time.

When choosing a suitable provider for a pension solution based on Pillar 3a, interested parties are quickly faced with the question of whether to choose a bank or an insurance company.

At first glance, the pension fund certificate is a mass of technical jargon and figures. But it's not that hard to make sense of it.