Key points at a glance

- It only takes a few clicks: In the AXA comparison portal you can choose your new basic insurance quickly, simply, and independently.

- We will take care of everything: We offer you a free health insurance fund switching service.

- Attractive premium savings: All basic insurance schemes in Switzerland offer the same benefits but different premiums. By switching basic insurance, AXA customers can save an average of CHF 426.

Want to save on basic health insurance?

With the health insurance fund switching service from AXA you can choose your new basic insurance with just a few clicks. We take care of terminating your existing cover and carrying out the switch for you. That way you’ll save an average of CHF 426 per year.

AXA does not offer basic health insurance – it only compares health insurers. The switching service can only be used by customers who have supplemental insurance from AXA.

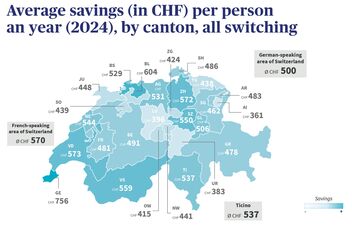

Savings dependent on canton of residence

It’s worthwhile taking a look at the cantons in order to save on health insurance fund premiums.

In 2026, our customers saved an average of CHF 426 on their basic health insurance premiums by using AXA’s free health insurance fund switching service in the fall of 2025. The chart shows how much you can save in your canton on health insurance premiums:

Find out more about the savings in our information sheet (in German) or in the complete AXA Switching Report (in German).

How can I change health insurance fund with the AXA service?

Comparing prices, obtaining quotations, terminating cover – all of this takes time. If you opt for supplementary health insurance with AXA, we will help you switch your basic insurance. It’s this easy:

1. Compare premiums

All basic insurance policies in Switzerland have the same benefits but not the same premiums. Use the AXA health insurance fund comparison to find the right model for you.

2. Select new basic insurance

Choose the basic insurance that best suits your needs in terms of the excess, service quality, and price.

3. Use the switching service

Sit back – we’ll do everything else for you. With our switching service we handle the termination and switch of your basic insurance.

AXA supplementary insurance and services

Choose AXA’s multiple-award-winning supplementary insurance and take advantage of unique services.

FAQs on basic insurance and the health insurance fund switching service

What is compulsory basic insurance?

Health insurance is compulsory for persons residing in Switzerland. The scope of the benefits provided is regulated by law. Insured persons pay a monthly premium for basic health insurance that is calculated based on their age, the region in which they live, and their choice of insurance model. Get an overview of health insurance in Switzerland with our health insurance guide.

What basic health insurance models are there?

The four most common basic insurance models are:

The basic type of compulsory basic insurance is the standard model, also known as the traditional model. With it, you have a choice of doctors, bus also pay the highest premium.

General practitioner model

As the name suggests, under the general practitioner model you first have to contact your general practitioner. Exceptions to this rule are gynecological preventive examinations, eye doctor checkups, and emergencies.

This is the model most frequently chosen by insured persons in Switzerland.

HMO model

An HMO practice consists of physicians, specialists, general practitioners, and therapists who provide medical treatment. Those insured under this model have to contact their HMO practice first, but benefit from lower premiums.

Telmed model

Under the Telmed model, your first point of contact is the telephone consultation hotline of your statutory health insurance provider. If necessary, they will refer you to a doctor’s office or a hospital.

How can I reduce my health insurance costs?

The greatest potential savings lie in switching regularly to the most affordable basic insurance. You lose no benefits by doing this. Although the benefits are regulated by law and are exactly the same for all basic insurers, premiums sometimes differ significantly.

If you opt for supplementary health insurance from AXA, we will find the cheapest basic insurance for you every year – and we also take care of the paperwork thanks to our free health insurance fund switching service.

For more tips visit our blog on the topic of saving on health insurance premiums.

Can I terminate my basic insurance cover without already having a new one in place?

As the name implies, compulsory health insurance is mandatory for everyone residing in Switzerland. So, if you decide to terminate your current health insurance, you must register with a new health insurance provider before the end of the year.