Save money on basic health insurance Compare health insurance

Want to switch your health insurer? AXA’s comparison of health insurers helps you find the cheapest basic health insurance.

In order to save on your basic health insurance premiums, you should compare Swiss health insurers every year and change your deductible. This site will let you directly access the comparison portal and find answers to all of your questions:

Note: AXA does not offer basic health insurance – it only compares health insurers.

Are you looking to switch insurers so you can save on your basic health insurance? By using AXA’s unbiased health insurer comparison, you’re only a few clicks away. This is what you need to do:

1. Enter your information

In order to give you the best quotes, we need some information about you. We will only use this information to make sure the calculations are correct. We will not save this information. This will help us make accurate calculations.

2. Compare premiums

Review all your quotes and choose the insurance that you like best. Basic health insurance benefits are exactly the same regardless of which insurer you choose. This is why you should go with the cheapest quote.

Our tip: As an AXA Healthcare customer, you can take advantage of our practical switching service. Simply select your new basic health insurance and we’ll cancel your current insurance and take care of the whole process for you.

The amount of your franchise directly influences how much you pay for your health insurance. If you choose a higher franchise amount, your monthly premiums will be lower, but you will have to pay a larger part of your healthcare costs yourself. Whereas the opposite is true if you choose a low franchise amount.

If you’re generally healthy, rarely visit a doctor and have some savings, then you should typically choose the maximum franchise amount of CHF 2,500. But if you regularly go to the doctor or do not want to take any risks, then you should choose the lowest franchise amount of CHF 300.

The deductible is the part of your healthcare costs that you must pay after reaching your franchise amount. For basic health insurance, this amounts to 10 percent or a maximum of CHF 700 for adults and CHF 350 for children per year.

In Switzerland there are several basic health insurance models you can choose from in addition to the standard model that lets you choose your doctor, such as:

By choosing a suitable model, you can lower your health insurance premiums considerably. Please make sure that the model you choose is right for your needs and where you live.

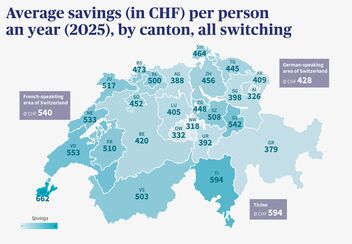

In 2026, our customers saved an average of CHF 426 on their basic health insurance premiums by using AXA’s free switching service in the fall of 2025. Find out how much money people are saving in your canton.

You should know that Savings are only available to AXA healthcare customers who have AXA switch their basic health insurance for them. Taking out supplementary insurance with AXA, for example, does not entitle customers to these savings.

Our Information Sheet (in German) and our AXA Switching Report (in German) provide you with more information on how to save.

There are several factors – such as which canton you live in – that affect which provider offers you the most affordable basic health insurance. Our health insurer comparison will list the various quotes from the lowest to the highest premium.

The AXA health insurer comparison is an unbiased, neutral offer provided to you completely free of charge. The health insurer switching service is exclusively available to AXA customers.