How to have a million in the bank when you turn 65

Retiring a millionaire. Sounds good, right? Well, the good news is that it’s a lot easier to have a million in the bank at 65 than most people probably think.

1. Optimize your taxes and retirement savings so they pay off

Pillar 3 is an important way for you to save. Most young people in Switzerland hear this pretty often. You need your own individual retirement plan if you intend to maintain your standard of living after you retire because with just Pillar 1 and Pillar 2 alone, you probably won’t have enough. What’s more, annual payments into a Pillar 3a account pay off twice over:

- Saving for your future: With Pillar 3, not only can you save for retirement, you can also put the money from your Pillar 3a account toward buying a house, becoming self-employed or moving out of Switzerland.

- Save on taxes: You can deduct the payments into your Pillar 3a account from your taxable income – even if you didn’t pay in the maximum amount. Not only is this a smart way to save, it also puts extra money back in your pocket. You could even take this cash and invest it in a Pillar 3b account – or buy something on your wish list.

Learn more about the 3 Pillar system in Switzerland in our blog.

2. Don’t let you money languish in a Pillar 3a account

You really can retire with a million in the bank. Provided you start saving early and invest some of the money well instead of putting it all into your Pillar 3a account. One type of solution is an individual retirement plan, which generally offers more attractive returns than a plain retirement account.

How does it work? If you start paying the maximum amount into a Pillar 3a solution at 25 and earn 5.5% in interest annually, then when you’re 65, you’ll have saved up a little over CHF 1 million. This works because the returns that you get from your investments every year are directly reinvested – so they grow exponentially. This article will tell you more about compound interest.

Benefit from the compound interest effect with the 3rd pillar

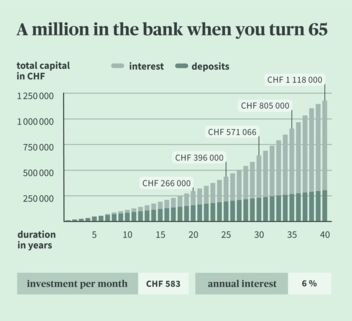

By keeping your money invested, every time the interest is reinvested, your assets grow exponentially. When you retire, not only will you get back the money you invested, but more importantly, you’ll also receive a large amount of interest, as shown in our graphic. The impact during the last ten years in particular is quite impressive. The retirement savings almost doubles from the 30th investment year (CHF 571,000) to the 40th (CHF 1,118,000).

With a Pillar 3a account, the situation looks a little different because the interest is much lower – ranging from 0.65% up to 1.35%. If you pay the maximum amount into a Pillar 3a account for the same period of time rather than investing it, you will have earned only CHF 370,500 after 40 years. This is because when the interest rate is low, compound interest cannot accumulate as quickly.

3. What about if I take a year or three off to travel the world? AHV/OASI retirement gaps

Extended studies, studying abroad or traveling the world – if you stop working in Switzerland for a longer period, you may get behind on your AHV/OASI payments. A retirement gap means less money for you when you retire. Depending on how big the gap is, your pension could be short a whole lot of money every month. This is precisely why it’s worth requesting an account statement from the compensation office to see whether you have any gaps. Don’t panic if you do have gaps. You have five years’ time to make up for the missing contributions so you receive your full AHV/OASI pension when you retire.

4. More work can pay off later

Do you understand how Pillar 1 (AHV/IV (OASI/DI)) and Pillar 3 (individual retirement savings) work? Then let’s talk about Pillar 2 (occupational benefits), which lets you save money in a pension fund. You start saving once you turn 25 and have an annual salary of at least CHF 22,680 (as at 2026). From this point onward, both you and your employer pay into the pension fund based on the salary you earn. We know this is easer said than done, but if you’re over 25 and earn less than CHF 22,680 (as at 2026) you should try to increase the hours you work so you meet the BVG/OPA minimum salary requirement – and consequently are insured under the pension fund.

5. The good news is that you can also save up on your own.

You know about Pillar 1, Pillar 2 and Pillar 3a. Now let’s talk about Pillar 3b. While your Pillar 3a account is restricted, which means you can’t withdraw your money from it to buy a new car or travel, your Pillar 3b account is unrestricted. You get to choose how you would like to use your Pillar 3b account to save for your retirement. Understandably, for many young people this is not really a concern. When your salary is still relatively low and there are so many things you want to do in life, saving for retirement is not a top priority for you. But in time, when you start to think about your future and how to plan for it, you’ll see that in addition to the mandatory, occupational and individual retirement accounts, you’ll need to set some money aside yourself. The good news is that investments in funds or equities, buying a home or endowment life insurance policies with regular premiums or a single premium all fall under Pillar 3b. Does all this sound complicated? It doesn't need to be. If you have some money set aside that’s not for emergencies or for fulfilling near-term dreams, the best idea is to learn more about Pillar 3b so you can make the most out of it over the long term.

Here’s the takeaway: How to make your money work for you

If you start saving early on, you can be a millionaire when you retire with very little effort on your part. The key here is to not let your money just sit around in a retirement savings account. You need to invest it and understand how to optimize your Pillar 1 and Pillar 2 savings. Then if you optimize Pillar 3b as well later on, you can make your money work for you even more. Follow these simple steps now and you can relax and enjoy life knowing that you’ve set yourself up for a cushy retirement. And an added perk is that every year your taxes will be lower.