Get 3 months free if you’re under 30

Key points at a glance

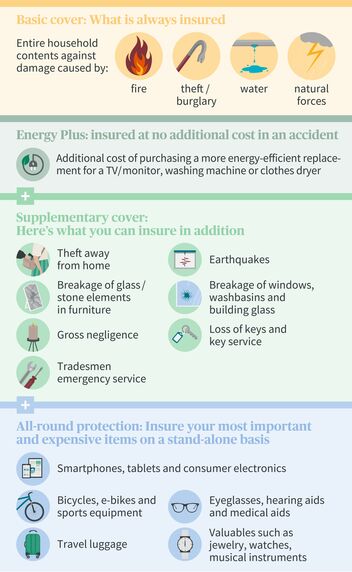

- Covers all important risks: Household contents insurance covers costs when it comes to theft as well as fire and water damage related to your home.

- Energy Plus: If certain appliances, such as a television, are destroyed during an insured event, we will pay any additional cost of purchasing a more energy-efficient appliance.

- Individual supplementary insurance: You can additionally insure expensive items that you are particularly fond of (e.g. jewelry, sports equipment, electronics, etc.).

Sales advice: 052 244 86 00

Get optimal cover for your household contents

If your home is broken into, the basement flooded following a storm or if thick smoke makes your cloakroom unusable, you can still stay fully relaxed if you have AXA's household contents insurance. We insure your household contents in full and ensure quick and straightforward processing if you have to make a claim.

Get 3 months free if you’re under 30

If you are under 30 years old and you buy a personal liability and/or household contents policy, we’ll give you the first 3 months of your annual premium for free. The discount applies to annual premiums starting at CHF 60.

Benefits of household contents insurance: here's what you can insure

You always want to be able to feel safe and secure at home within your own four walls. Insurance protection from AXA ensures that even after water damage or burglary and theft, you do just that thanks to broad risk cover and quick, uncomplicated help. The insurance protects you against these risks and their financial consequences. Find out here how the insurance is structured, what basic cover is included and which additional benefits you can choose:

Here's how our household contents insurance works

Basic cover under household contents insurance - automatically insured risks

- Fire and natural hazards: Your entire household contents are insured at reinstatement value against damage from fire and natural hazards such as storm, high water and floods, hail or avalanche.

- Energy Plus: If certain appliances, such as a television, are destroyed in an insured accident, we will pay the additional cost of replacing them with an energy-efficient model.

- Theft: Simple theft as well as theft and burglary are among the generally insured risks. If criminals gain access to your home and steal or damage your possessions, we ensure that these are replaced.

- Costs relating to claims: Of course you are not responsible for the costs associated with an incident either. The cost of cleaning up after water damage or for the re-issue of identity documents and other documents is also insured.

Supplementary cover under household contents insurance – insurable risks if required

Through its modular structure, household contents insurance from AXA can be expanded in line with individual needs as a type of "household contents accidental damage". This way you only insure what you want to and only pay for other benefits you actually need, such as protection for your art collection or house keys.

- Theft away from home: This is advisable if you would like insurance cover for possessions that you have taken with you when traveling in Switzerland or abroad. If your handbag is stolen when you're in a café or your bicycle is stolen from a railroad station, we assume the loss.

- Breakage of windows, washbasins and building glass: Makes sense for homeowners who would like to be fully insured against financial risks. If, for example, the new washbasin is damaged by a falling perfume bottle, AXA pays for the damage.

- Stone or glass breakage for furnishings: This is worth considering if you have fittings in your house that are made of glass and stone. If a glass jar falls onto the marble top in the kitchen and damages it, we pay for all the associated costs.

- Earthquakes: Luckily earthquakes are not commonplace in Switzerland, but they can happen and can be devastating. If you want to protect your belongings against this natural disaster, you can do so. Earthquakes are an insured risk under our supplementary cover.

- Gross negligence: It makes sense to extend the insurance to anyone who would like to be on the safe side, even if they have caused the damage themselves. If unattended candles cause a fire in your home, the benefits of AXA supplementary cover will not be affected, even in the event of gross negligence.

- Loss of keys and key service: A good thing and not only for tenants, as it's always expensive to have locks opened and replaced. If, for example, you lose your key to your rental or holiday home, we organize a key service and also pay to have the locks changed.

- Emergency home services: To prevent small claims getting unnecessarily larger, such as blocked drain pipes when quick support is required. We arrange the services of a tradesman and pay the costs.

All-round protection - extra protection for your favorite possessions

Different things are dear to people. You can have your personal favorite possessions comprehensively insured with these benefits - against damage caused by other people or by you accidentally, exactly as against loss or theft.

- Smartphones, tablets and consumer electronics: You drop your cell phone or another electronic device and it's broken - this additional option ensures that you don't have to pay for a replacement or for repairs.

- Bicycles, electric bikes and sports equipment: You fall off your bike or electric bike and it's badly damaged. AXA covers the costs of the repairs.

- Luggage: Your luggage arrives in the hotel late - we pay the costs for necessary purchases or the costs for replacements if your luggage never arrives.

- Glasses, hearing aids and medical aids: You accidentally sit on your glasses and damage them. It costs several hundred Swiss francs to replace them and AXA covers this.

- Jewelry, watches and musical instruments: Your wedding ring slips off your finger when you're swimming in a lake or your Rolex is damaged after falling onto the tiled bathroom floor. Blunders you can insure against.

Examples of damage/loss

Support and frequently asked questions

My smartphone display is damaged. Does my household contents policy cover this?

Yes, mobile devices (mobile phones, tablets, notebooks) are covered if you have taken out the supplementary all-round protection module "Smartphones, tablets and consumer electronics." Basic household contents insurance only covers your smartphone against damage from fire, water, natural hazards and theft.

What damage does household contents insurance cover?

Household contents insurance is divided into basic cover and supplementary cover.

Basic cover insures damage to your household contents due to fire, theft or burglary, water and to events caused by natural hazards.

With supplementary cover, you can insure against other risks, such as gross negligence, theft away from home and much more - individually depending on your needs.

My handbag was stolen unnoticed in the restaurant. What is insured?

This is ordinary theft. If you have included supplementary coverage "ordinary theft away from home" in your policy, your handbag (incl. identification documents, cellphone, etc., but excluding cash) is covered up to the agreed sum insured. The costs of replacing your ID, documents, personal subscriptions, etc. is covered. In an emergency we can organize a key service for you within 24 hours – just call us on 0800 809 809.

I have lost the key to my owner-occupied apartment. What do I do next?

In this case there is the supplementary coverage module "Loss of keys and key service": This coverage assists you if you lose a key or lock yourself out. Your keys to your own apartment are covered together with third-party keys such as those belonging to an association or a business. The supplementary coverage pays the costs for the key service, for replacement keys and for changing the locks.

My luggage hasn't arrived at my destination airport. What's covered in such a case?

With all-round protection for luggage, the costs of necessary purchases are covered up to CHF 1,000. If your luggage never arrives, the costs for replacing the lost items are also paid up to the agreed sum insured.