Switzerland’s health system: the key points in brief

A very high standard, but high costs too – probably everyone knows at least that about Switzerland’s health system. Take a closer look though, and what you’ll discover is an unbelievable level of complexity. We're here to help you navigate your way around the health system in Switzerland.

The first steps are always the hardest. Especially when you find yourself confronted with a health system in a foreign country. What do I have to do? How and when do I have to do it? And where do I start? To help you find your feet, let's start at the very beginning.

Registering with a Swiss health insurance fund

Everyone who is resident in Switzerland must take out basic health insurance. Unlike many other countries, here this is something you do privately; in other words, you have to take care of it yourself. People who move to Switzerland have three months from the time they arrive to register with a health insurance fund. There are around 40 health insurance funds to choose from. These funds are obliged to accept everyone, regardless of any health conditions they may have. While the benefits under compulsory health insurance are laid down by law, premiums can vary markedly. Which is why it's worth comparing a number of offers. Use AXA’s free and neutral health insurance comparison. You can change health insurance fund from the start of every calendar year, but you have to give notice by November 30: by this date at the latest your current health insurance fund has to have received your notice of termination.

Not all health insurance funds charge the same fees

Essentially, all health insurance funds cover the same benefits in terms of medical treatments and medications in the basic insurance segment. This is prescribed by law. This said, there are big differences when it comes to monthly premiums. Age, sex, and place of residence have an influence on how much the premium will be. Premiums not only vary from canton to canton, but the cantons themselves are also broken down into different premium regions. The biggest influence on how much premium you pay, however, comes from what is known as the “franchise” amount (cost contribution) and the insurance product involved.

Affordable basic insurance: the factors that dictate how much you pay

To a large extent, the steps you take yourself can determine how much you end up paying. There are, of course, cheap offerings, expensive ones, and some in between. The following two factors, however, have a considerable impact on your premium regardless of which option you choose.

Franchise amount (cost contribution)

You decide on the amount starting from which your health insurance fund pays your bills: CHF 300 is the lowest option for adults, while CHF 2,500 is the highest possible franchise amount. Once your franchise amount has been reached, from then on you only pay 10% of your health-related invoices, and your insurance takes over the lion's share of the costs. The higher the franchise amount, the lower the monthly premiums for your health insurance fund. Incidentally, experience has shown that cost contributions in the mid-range segment are not financially attractive for insureds, and that it makes sense – depending on your state of health – to choose either the lowest or the highest franchise amount.

Tip: Those who need to see the doctor or have treatment often are better off choosing the lowest franchise amount of CHF 300. The maximum amount – depending on the insurer involved, CHF 2,000 or CHF 2,500 – is ideal for all those who

- regard themselves as in good health,

- are not planning to have any medical treatments, and

- have some money put aside to cover unexpected medical bills.

Insurance model

The standard model used in our health system is the free choice of doctor. If you're willing to forego that, you can save a substantial sum of money. By choosing an alternative model, you undertake to always contact your general practitioner first if you experience any health issues (General Practitioner model), or a specific group practice (HNI model), or a specific medical hotline (Telmed model). But be aware that, if you don't follow the rules, you may find yourself facing a substantial penalty. In some cases, you will have to pay the bill yourself or you will be reassigned to the more expensive standard model, even if you don't want to be. And you're not always warned beforehand. Here, too, it’s important to read the small print.

Tip: Weigh up the advantages and disadvantages of alternative models very carefully. Check, for instance, that the health insurance fund you're considering works with your general practitioner, or that one of the HNO group practices listed is nearby. You’ll find the lists on the health insurers’ websites.

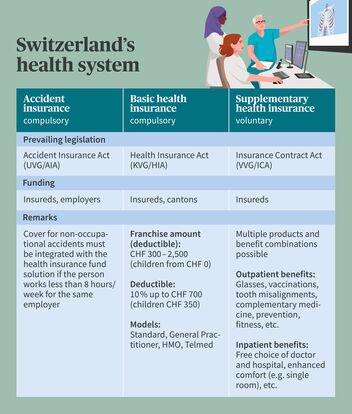

Special case: accident insurance

Accident insurance is the only health-related insurance policy that operates via employers (from a level of employment from 8 hours per week in the same company). Premiums are split between the employer and the employee.

For those who work fewer than 8 hours a week, non-occupational accident insurance has to be taken out with a health insurance fund.

Not included in Switzerland: dental insurance

Unlike in Germany, for example, dental treatment is not covered by compulsory basic insurance in Switzerland. The same applies to glasses, complementary medicine, free choice of hospital or doctor, and treatment abroad. To cover such things, many adults and children take out voluntary private health insurance known in Switzerland as supplementary insurance. However, providers of supplementary insurance are not obliged to accept applicants.

Save on health costs: here's how

The most important lever for bringing down your health-related costs is what is known as “splitting”. But first things first:

what does splitting involve?

Compulsory statutory basic insurance and voluntary supplementary insurance are completely separate from one another in Switzerland. This means you can have insurance with different health insurers, i.e. your basic insurance with one provider and your supplementary insurance options with another. This is known as splitting.

What are the advantages of splitting?

There is one key difference between the two types of insurance:

- basic insurance has to accept everyone. Which means that you can terminate and change your health insurer every year, no problem.

- In contrast, a supplementary insurance provider can reject applications. Which means that only young and healthy people can change relatively automatically.

As soon as you have regular treatments or certain health risks, you become tied to your supplementary insurance provider. Which doesn’t mean that you have to stay with the same basic insurance provider. Because depending on how premiums develop, you could easily save yourself several hundred francs each year by changing provider.

Why do people not “split” more often?

It’s still the case that most people in Switzerland have all their health insurance-related contracts with just one health insurance provider. Generally for one of the following reasons:

- Most people simply don’t know that splitting is possible and that it makes sense.

- A lot of people are put off by the amount of extra administrative work they think is involved, if they can no longer submit all their health-related invoices to the same provider. They’re also put off by the amount of paperwork they think switching would entail.

- Some health insurance providers offer “combo” options with discounts and other advantages.

These reasons quickly pale in comparison, however, when you look at how much money can potentially be saved. For families on a tight budget, for instance, it really pays to put in the extra effort and compare the different basic health insurance premiums on offer each year. It can make a real difference to their budget. With our health insurance fund switching service, we’ll be happy to help you find the most affordable basic insurance for you and also switch to the most affordable health insurance provider if you wish.