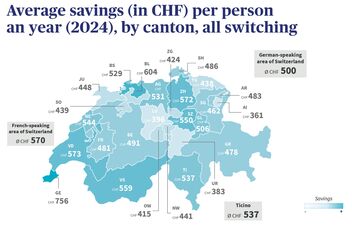

Savings dependent on canton of residence

Would you like to cut the cost of your basic health insurance? Our switching service will help you do just that.

*In 2025, our customers who used AXA’s free switching service in autumn 2024 will save an average of CHF 456 on their basic insurance premiums. Find out how much is saved in your canton and utilize your savings potential next year.

Find out more about these savings in our information sheet (in German) or in the complete AXA switching report (in German).

Good to know: AXA does not offer basic health insurance – it only compares health insurers. You can find the most affordable basic health insurance using our comparison platform. And if you have supplemental health insurance from AXA, we’ll even take care of the switch. So how about it? All you have to do is decide.

Here’s how easy the switching service is

AXA’s supplementary health insurance options

Unlike with basic insurance, the benefits offered under supplementary insurance vary. Is money toward your gym membership important to you? Or payments toward complementary-medicine therapies? Perhaps you regard privacy during a hospital stay as a must?

Only supplementary insurance can cover these needs. And by taking out supplementary insurance with AXA you’ll be opting for top-flight, award-winning products.

FAQ – Supplementary health insurance

How do I benefit with AXA?

In addition to our attractive range of supplementary insurance products, we can assist you in your free choice of a basic health insurance provider. We don’t offer any basic insurance ourselves, but help you find the best solution in terms of price and quality each year. To ensure our advice is unbiased, we don't receive any commission on basic insurance.

How does the switching service for basic health insurance work?

Comparing prices, obtaining offers, and terminating policies all takes time. If you opt for supplementary health insurance from AXA, each fall you receive from us a proposal for the most cost-efficient basic insurance available.

If you agree to our proposal, we’ll take care of all of the paperwork involved in terminating your old insurance and registering you with your new basic insurer. This means that you can save around CHF 500 in premiums each year without having to lift a finger, while families can even save up to CHF 2,000.

How can I reduce my health insurance costs?

The most savings potential lies in switching regularly to the most affordable basic insurance. You lose no benefits by doing this. The benefits are governed by law and are exactly the same for all basic insurance products, but premiums sometimes differ significantly.

Opt for supplementary health insurance from AXA, and every year we’ll find the most affordable basic insurer for you – plus we’ll take care of your paperwork.

Where do I send my health bills?

Our invoicing service is there to ensure that things run smoothly after you switch: you send us your invoices and we take care of the rest.

What happens if basic insurance doesn’t want to pay?

Whether your mandatory basic insurance is refusing to cover a claim or your plans to switch basic insurance meet with unexpected problems: our free legal protection service is there to help.

Tips on all aspects of health insurance

Saving on health insurance premiums – here’s how it works

We’ve got a few tips on how you can save on health insurance premiums – for instance by increasing your franchise deductible, choosing an alternative insurance model, or splitting.

“Save more, same effort, comprehensive protection”

“Saving money on something I need anyway? What a great idea!” Robin Birrer explains why it’s worth taking a look at supplementary health insurance from AXA.

Emergency abroad: What does the health insurer pay?

Vacation – the best part of the year! But what if, just then, you’re ill or you have an accident?