Key points at a glance

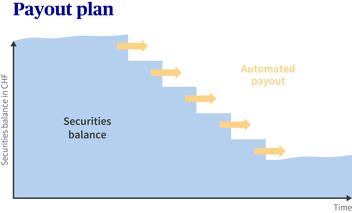

- Individual investment portfolio: With EasyInvest, you put existing funds and pension capital to profitable use and secure regular additional income for retirement.

- Profitable and flexible: When structuring your payout plan, you benefit from a personal investment strategy, professional management of your funds and a high level of flexibility.

- Invest like the pros: You benefit from low fund costs and the same conditions as institutional investors.

The easy way to invest your money and earn an additional stream of income

The EasyInvest payout plan is exactly what a modern payout plan should be: an investment portfolio that is specifically tailored to your needs, professionally managed, easy to use and gives you flexible planning options. The plan is a special investment service provided free of charge by EasyInvest discretionary management. EasyInvest lets you invest like a pro and puts your money to work for you. It couldn’t be easier.

Your advantages with the EasyInvest payout plan

- Flexible planning: Have your money paid out at the time and in the amount you want, and adjust your payout plan whenever you like.

- Individual investment portfolio: Use a customized personal strategy to optimize your investments during the payout stage.

- Make changes anytime and from anywhere: Changing the amount of your payouts couldn’t be easier.

- Attractive conditions and straightforward pricing: You benefit from low fund costs and the same conditions as institutional investors.

- Invest like AXA, supported by comprehensive services: Our financial experts take care of services such as selecting, monitoring and reallocating investment instruments, processing market orders and preparing your tax statement correctly.

- 24/7 online services: Our customer portal lets you check on your investments at your convenience and make changes at your discretion.

EasyInvest in 3 steps

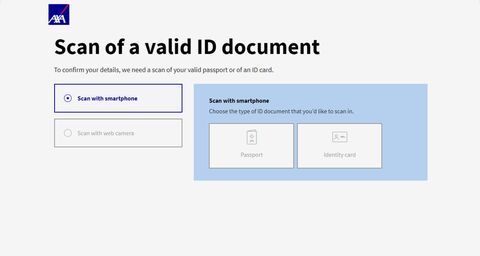

1

Sign up in the myAXA pensions portal

2

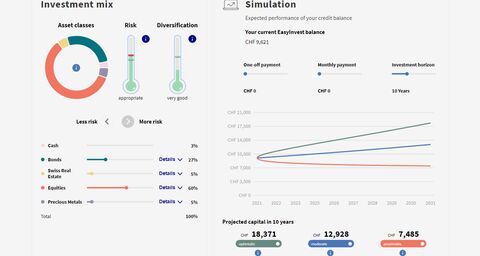

Determine your risk profile and investment mix

3

Verify your identity and sign the contract

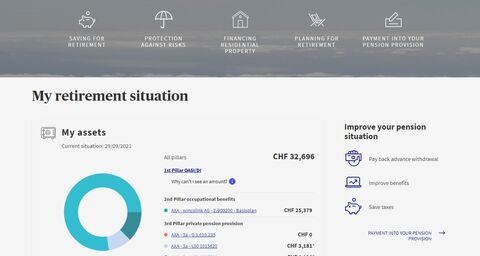

myAXA customer portal

Set up your EasyInvest investment profile now to get secure online access to your investment account any time you want.

Go directly to myAXA | Information about our customer portal

Withdrawing your assets – what you need to know

Use the EasyInvest payout plan if you would like to boost your retirement income.

The EasyInvest payout plan allows you to invest your money and have part of it paid out automatically to provide an additional source of regular income. You don't need any specialist knowledge, and you benefit from competitive terms and maximum flexibility.

Frequently asked questions

Do I need special knowledge or experience to sign up for EasyInvest?

No. Everything you need to know will be explained to you in plain language either by your retirement advisor or in the customer portal. We will clearly explain the risks, opportunities and costs of your personal solution.

AXA financial experts will take care of the more complex tasks, such as selecting, monitoring and reallocating investment funds or executing market transactions.

The only thing we need your help with is determining your risk profile, which we will use to propose an investment strategy for you. You can – but do not have to – change your strategy at any time. You have a choice: You can either 1.) just sit back and invest based on the personal investment suggestions made by AXA; or 2.) make your own changes to the various asset classes (e.g. how much you would like to invest in stocks); or even 3.) make adjustments within the individual asset classes (e.g. how much you would like to invest in stocks of Swiss companies).

How much flexibility do I have with EasyInvest and how easy is it to withdraw my money?

EasyInvest can be adapted to accommodate your personal financial circumstances and requirements: You can make deposits and withdrawals and make changes to your investment strategy at any time. There is no cancellation period.

How safe is the money I invest?

Your investment is subject to the usual risks of the capital markets. We aim to reduce these risks through broad diversification and by carefully selecting investment funds and a suitable strategy.

There’s no need to worry about AXA or the custody bank going bankrupt because we do not hold your securities assets or cash savings. They are held by Bank CIC as separate assets or are insured under deposit insurance.

- Your securities assets are held at Bank CIC as separate assets. In the hypothetical case of bankruptcy, the funds will not be included in the bankruptcy assets of the account-holding bank, but will remain your property.

- Your cash savings (which normally make up just 3% of the amount invested) are insured under deposit insurance for up to the first CHF 100,000.

- If AXA files bankruptcy, your investment will remain at Bank CIC until you give the instruction to close your account and custody account or transfer the discretionary management mandate to another asset manager.

Legal & Documents

In order to better protect investors, Switzerland passed the Financial Services Act (FinSA) in January 2020. Below you will find related information about the duties of conduct, implementation and organization required of AXA Insurance Ltd.

Please note that the information and documents published on this website constitute advertising under Art. 68 of the Swiss Financial Services Act (FinSA) and are provided for information purposes only.

Always there for you

Do you have any questions about investing or would you like a no obligation financial or retirement planning consultation? Our experts are there for you.

Some more interesting reads for you

Do you have questions about your pension fund certificate?

At first glance, your pension fund certificate may seem like an incomprehensible jumble of technical terms and random numbers. But when you know what you’re looking at, it’s actually pretty straightforward.

Annuity or lump sum?

As retirement draws nearer, you need to think about how you want your retirement savings paid out. You can choose between a regular annuity and a one-time lump sum.

Do you have legal questions about a will or inheritance?

The inheritance tax law has been in force since January 1, 2023. What are all the things that need to be taken into account? You'll find the answers to the most important questions here.