Key points at a glance

- Professional and flexible discretionary management: With EasyInvest, you benefit from professional management of your assets, an investment portfolio specifically tailored to your needs and maximum flexibility for deposits and payments.

- Invest like the pros: With EasyInvest, all you need is just CHF 1,000 to benefit from the same conditions as institutional investors and from low investment costs.

- Independently or together: Manage your assets independently online or receive step-by-step support from our pension experts.

Investing made easy

EasyInvest discretionary management is exactly what modern portfolio management should be: an investment portfolio that is specifically tailored to your needs, professionally managed, easy to use and gives you flexible access to your assets. EasyInvest lets you invest like a pro and puts your money to work for you. It couldn’t be easier.

Your advantages with EasyInvest

- Individual investment portfolio: With EasyInvest, you invest existing funds and retirement savings to profitable effect and secure regular additional income for your retirement.

- Make changes anytime and from anywhere: You can make adjustments to your investment strategy at your discretion and convenience. Your contract does not have a fixed term.

- Attractive conditions and straightforward pricing: From as little as CHF 1,000, you can take advantage of low investment costs and enjoy the same conditions as institutional investors.

- 24/7 online services: Our customer portal lets you check on and adjust your investments whenever you want.

- Attractive services for depositing and withdrawing your assets: Take advantage of investment management for staggered deposits or the EasyInvest payout plan if you would like to have your funds paid out regularly to supplement your income.

EasyInvest lets you invest just like AXA does:

- Guaranteed affordable fund costs, optimized performance and good investment management – selection of affordable ETFs and superior investment funds from top-notch firms

- Investment funds selected, monitored and reallocated by AXA finance experts

- We take care of all the supporting services, such as selecting, monitoring and reallocating investment instruments, processing market orders and preparing your tax statement correctly.

- Talk to your retirement advisor any time about the opportunities, risks and options for your investment strategy.

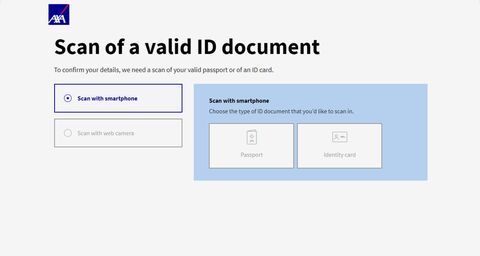

EasyInvest in 3 steps

1

Sign up in the myAXA pensions portal

2

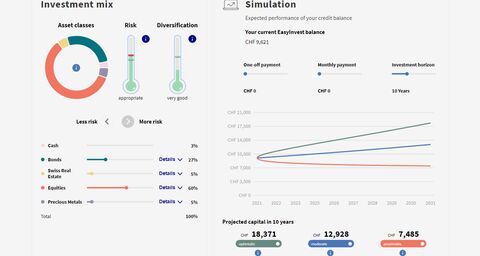

Determine your risk profile and investment mix

3

Verify your identity and sign the contract

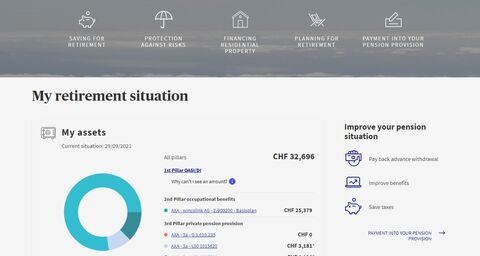

myAXA customer portal

Set up your EasyInvest investment profile now to get secure online access to your investment account any time you want.

Go directly to myAXA | Information about our customer portal

Investment options

Would you like to help manage your investment risk? Then customize the parts of your investment portfolio you want to control. Would you rather not have to bother keeping up with the stock markets? Then take advantage of AXA’s extensive investing expertise. EasyInvest gives you both of these options.

Simply choose the investment strategy that's right for you:

- Personal investment strategy: We will suggest an investment mix that suits your personal risk profile and return expectations.

- Efficient mix of ETFs, index funds and actively managed funds: In established markets, we invest in affordable ETFs and index funds. In markets with more challenging structures, we enlist the expert knowledge of qualified fund managers to unlock additional performance opportunities.

- Investment management services provided by AXA pension funds: Same asset allocation and selection of investment vehicles used by pension funds

- Flexible investment strategy: Update your investment strategy at any time.

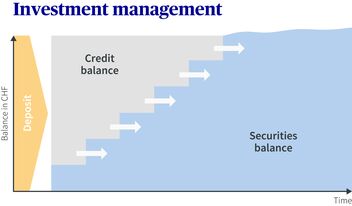

- Minimizing risks through staggering: You decide at what intervals you want to stagger your investments – we automatically implement your choice, optimized for your needs.

Investing your assets – what you need to know

Use investment management from EasyInvest to stagger the money you pay in and keep building up your assets over time.

Frequently asked questions

Legal & Documents

In order to better protect investors, Switzerland passed the Financial Services Act (FinSA) in January 2020. Below you will find related information about the duties of conduct, implementation and organization required of AXA Insurance Ltd.

Please note that the information and documents published on this website constitute advertising under Art. 68 of the Swiss Financial Services Act (FinSA) and are provided for information purposes only.

Always there for you

Do you have any questions about investing or would you like a no obligation financial or retirement planning consultation? Our experts are there for you.

Some more interesting reads for you

Pillar 2 – occupational pensions

The purpose of Pillar 2 is to enable people to maintain their accustomed standard of living after retirement.

Part-time and pension funds: Mind the retirement gaps!

More and more people are working part-time in Switzerland. If you don’t actively manage your retirement, you could end up with a massive gap.

Annuity or lump sum? Which is better?

As retirement draws nearer, you need to consider how you want the money you’ve saved in your pension fund paid out.