Funding ratio of pension funds

When choosing a (new) pension fund, you should normally consider and compare the range of offers. But for non-professionals, it is often difficult to properly classify and interpret the many different financial figures. We explain what the funding ratio is and what you should bear in mind.

What is the funding ratio of pension funds?

One of the most important and well-known figures for rating a pension fund is its funding ratio; this mirrors the ratio between its assets and its payment obligations towards current employees (currently active contributors) as well as retirees. It therefore reflects the ratio of assets to the respective pension fund's payment obligations.

The basic rule is that the higher the funding ratio, the better. A general guide is that 100 percent must be reached or exceeded. But it's not quite that simple.

What is surplus coverage?

If a pension fund has more assets than payment obligations, the funding ratio is therefore greater than 100 percent, i.e. there are surplus funds. This means that the pension fund has set aside reserves and can distribute future profits, particularly investment profits, quicker to insured members, e.g. in the form of higher interest.

What is underfunding?

The opposite applies when a pension fund is underfunded: in this case, the pension fund has more payment obligations than assets, so the funding ratio is less than 100 percent. The pension fund must analyze why it is underfunded and take remedial steps if the underfunding has a structural cause and it is not possible without measures to return to a funding ratio of (at least) 100 per cent in the medium term. Foundations with a fully insured plan cannot be underfunded. This is because pension fund assets and payment obligations are fully outsourced to an insurance company which bears all the risks.

However, to be able to compare the respective funding ratio of pension funds, you first have to know how it is calculated.

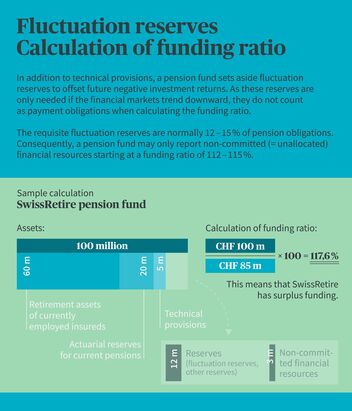

How is a pension institution's funding ratio calculated?

A pension institution's funding ratio is calculated by dividing total assets by total payment obligations.

Assets here comprise all pension fund assets (e.g. credits in accounts, equities, bonds, real estate, alternative investments) at current market value.

In turn, a pension institution's payment obligations cover

- the retirement assets of insured contributors

- the actuarial reserves of current pensions

- technical provisions

1.) Retirement capital of current employees

The currently insured employees have a claim against their pension fund for their saved retirement assets (also known as vested benefits) which must be paid out when required (e. g. if they change pension funds, for example, due to a change of employer, withdrawal as part of purchasing a home or if the person in question moves abroad).

2.) Actuarial reserves of retirees

The actuarial reserves of current pensions correspond to the total value of expected future pension payments that the pension fund must make.

3.) Technical provisions

Technical provisions are financial reserves for all additional payment obligations that are foreseeable today, i.e. that the pension fund calculates for the future. For example, because actuarial reserves of current pensions have to be revalued and increased due to falling interest rates. Or because the retirement assets saved by insureds at the time of retirement are insufficient to fund their pension, thus giving rise to retirement losses.

Technical interest rate and funding ratio

Why you should look at both figures: if you want to compare the funding ratios of Pillar 2 solutions, you must also take a closer look at the technical interest rate.

What is the technical interest rate?

The technical interest rate is the expected investment return on the retirement assets of insureds during the pension period (i.e. on the portion of retirement assets that have not been paid out in the form of pensions). This means that the technical interest rate should reflect the pension fund's expectations for long-term returns.

If a pension fund assumes a technical interest rate of 2 percent, it should also be able to achieve a return of at least 2 percent in the coming years.

Does the technical interest rate affect the funding ratio?

The technical interest rate directly affects the funding ratio, as the actuarial reserves to be set aside for future pensions depend on it. To what degree? Very simply, if a pension fund works with a higher technical interest rate, it is expecting higher investment returns accordingly. These "additional revenues" reduce the actuarial reserves to be set aside (the pension fund must therefore provide for fewer reserves today in order to fund pensions). The pension institution's payment obligations consequently fall while its assets remain unchanged, which causes the the funding ratio to rise.

Note: as current pensions cannot be reduced, pension funds must be very prudent when setting the technical interest rate. Furthermore, the assumed income should actually be achievable on the financial markets with low-risk investments.

Who sets a pension fund's technical interest rate and what should be borne in mind when assessing it?

The technical interest rate set may vary from pension fund to pension fund. It is not simply determined as a discretionary figure, but is based on requirements laid down by an expert appointed by every pension fund. In this context, the expert not only considers the expected net return based on the investment strategy, but also specifically the structure of insured members, e.g. the proportion of retirees. Based on the expert recommendation, the board of trustees then ultimately decides what the ultimate technical interest rate will be.

When comparing the funding ratios of different pension institutions, you should always look at the technical interest rate.

Comparing pension fund figures - what you should bear in mind

The funding ratio is one of the most important figures to consider when assessing a pension fund or collective foundation, but it is only ever a snapshot. The funding ratio also depends on a variety of factors and should therefore never be looked at in isolation.

There are also a number of dimensions that are essential for assessing a pension fund that are not directly reflected in the funding ratio. For example:

- age distribution of insureds

- proportion of retirees

- ratio between mandatory and voluntary retirement assets

- conversion rates

- pension institution's investment strategy (including required target return)

- risks covered by an insurance company

- interest paid on retirement assets in the last few years

If, as an employer, you would like to choose the right occupational benefits for your employees, there are a number of factors to bear in mind. The annual financial statements published by every pension institution are a good starting point, as they contain relevant information and key figures.