Do you want your company to continue to thrive after your retirement? If so, it's worth thinking about succession planning in good time. You can thus ensure the continuation of your business after your departure and invest in a carefree retirement.

Why is succession planning so important?

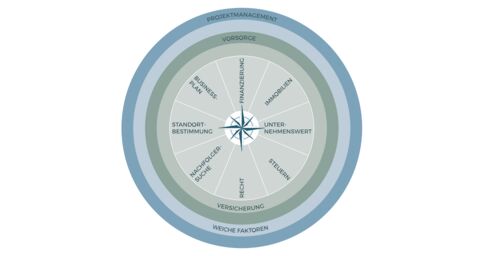

Handing on your life's work presents considerable challenges for everyone involved. Numerous factors need to be taken into account when managing a company succession. Consideration has to be given not only to looking for a suitable successor, but also to separating out personal and business assets, with due regard to tax and legal matters.

Failure to consider these factors may result in the loss of jobs and expertise and in excess tax payments – jeopardizing the survival of your business. Planning your succession in good time will consequently help ensure that your company continues to thrive after you retire.

Support and frequently asked questions

When should companies start planning for succession?

It pays off to plan your company succession in good time. People often underestimate how much time and energy it takes to find the best solution for the future. Early, long-term planning is the only way to give yourself the necessary scope to identify and implement the optimal succession solution. You should allow at least three to five years in order to hand over a company under optimal conditions. This will enable you to ensure the survival of your business and secure your employees' jobs.

At the same time, it lets you – the seller – plan ahead for retirement and safeguard your financial security. This structured approach is of major benefit not only in the normal course of events, but also when an unforeseen situation arises – such as illness or accident.

Is succession planning a good idea for other people as well as business owners?

The general aim of succession planning is to fill key positions when someone leaves. Succession planning is therefore useful at other times, and not just when a company changes hands. It is also a proven means of supporting talent management and employee development, since it ensures that posts are filled (internally) as efficiently as possible when they become vacant.

I'd like to sell my company when I retire. What do I need to bear in mind when planning my succession?

It's also worth investing in appropriate succession planning at an early stage if a company is expected to be sold. At the end of the day, your company is being handed over to an external party that is not yet familiar with your internal processes and how your business works. It is therefore all the more important to prepare for the handover as thoroughly as possible. Our blog post "A step-by-step guide to planning your company succession" sums up how you can ensure that your company retains its expertise and other success factors after it has been sold.

More tips for your succession planning

Selling a company: What you should be aware of

How do I set the right selling price for my company? Where do I find the right buyer? What tax factors should be taken into consideration? You'll find answers to the most frequently asked questions on selling companies here.

Succession planning in a family business

When a company is being handed over to the next generation, this is not just an emotional challenge for the owner. Find out here which five questions you should ask about succession planning in a family company.

Management buy-out

The alternatives to family succession are becoming increasingly important with demographic changes. Read here about what you should be aware of if you are handing your company over to the existing management and what the pros and cons of a management buy-out are.