Key points at a glance

- Customizable investment asset choices: With 1e Invest, insureds can determine how their retirement savings from the part of their salary that exceeds CHF 136,080 is invested.

- Freedom to decide: Your staff chooses their investment strategy themselves, in line with their personal preferences.

- Everything is online: AXA 1e Invest gives companies and their employees a modern and fully digital solution for their 1e pension savings.

Alternatively, your questions can be answered quickly and easily by phone: Arrange an appointment today.

What is the 1e pension solution?

The Swiss Occupational Pensions Act gives insureds who earn a salary of over CHF 136,080 more options for investing their retirement savings. Salary amounts above this threshold can be insured in a separate pension solution known as the 1e pension solution. With this solution, insureds choose the investment strategy that suits their personal retirement circumstances. What’s more, the 1e solution from AXA provides companies that apply international accounting standards (IFRS, US GAAP) with opportunities to lighten their balance sheets.

Advantages of the 1e pension solution for employees

The modern 1e pension solution from AXA provides insureds a high degree of customization, flexibility and transparency for the extra-mandatory portion of their retirement savings:

- Individual investment strategy: Insureds choose from five investment strategies with different equity allocations based on their personal risk tolerance and retirement situation.

- Highly flexible investment process: The selected strategy can be changed at any time online and free of charge. The AXA online portal makes it quick, easy and convenient.

- Full transparency and complete control: Insureds can view all the relevant information about their 1e pension plan and the investment strategies anytime on the online pensions portal.

- Safe against collective losses: There is no risk of underfunding or restructuring contributions because everyone saves for themselves, independently from the group – this way there is no redistribution of the returns.

- Tax advantages on investment income: Income earned during the savings phase – such as interest, dividends and capital gains – remains tax-free and improves the net return on the pension plan.

- Full payout in the event of death: If an insured dies, their retirement savings will be paid out in full (no deductions) to their survivors.

- Attractive management pension solutions: The 1e pension solution is the ideal way to supplement the basic retirement plan, especially for managers who earn more.

Advantages of the 1e pension solution for employers

AXA’s 1e pension solution also offers numerous benefits for companies, enabling them to position themselves as a modern and future-looking employer.

- Boost your attractiveness as an employer: Our flexible and transparent pension solution aids you in recruiting and retaining qualified specialist and management staff.

- Customizable pension plan: The 1e pension solution can be adapted specifically to fit your corporate structure and culture.

- Full cost transparency: The cost premium does not depend on investment volumes.

- Risks are fully reinsured: Actuarial risks such as death and disability are covered by AXA Life Ltd for maximum security and predictability.

- Optimize the balance sheet: For IFRS or US GAAP accounting, this could be a way to lighten the balance sheet – ideal for listed or international companies.

- Entirely online: AXA 1e Invest offers companies a modern and fully digital solution for managing the 1e pension solution, making it possible to simply and efficiently complete all administrative tasks online.

What investment strategies are available?

In contrast to the classic Pillar 2 pension funds, AXA 1e Invest offers insureds the option of choosing their investment strategy for their 1e pension themselves – tailored to their personal risk tolerance and circumstances.

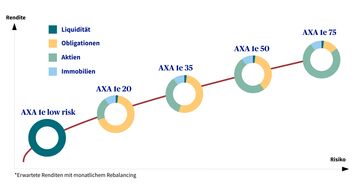

There are five strategies to choose from with different equity allocations:

- AXA 1e low risk: 0% equities (corresponds to the low-risk strategy defined under the law)

- AXA 1e 20: 20% equity allocation

- AXA 1e 35: 35% equity level

- AXA 1e 50: 50% equity level

- AXA 1e 75: 75% equity allocation

All strategies benefit from the expertise of AXA Asset Management:

- Independence through best-in-class approach

- Top price/benefit ratio

- Active tactical investment decisions and risk management

The AXA Foundation 1e

The AXA Foundation 1e in Winterthur was established in 2022. Its purpose is to arrange occupational retirement, survivors’ and disability pension provision for its affiliated companies. It provides services beyond mandatory occupational pension plans, offering 1e pension plans exclusively for incomes over CHF 136,080.

Frequently asked questions

What are the advantages of a 1e pension solution from AXA?

The 1e pension solution from AXA gives insureds the freedom and flexibility to manage their retirement savings on the portion of their salary that exceeds CHF 136,080 – with a choice of investment strategy, full cost transparency and attractive tax benefits. The AXA Occupational Benefits Foundation sets up the legal framework and ensures compliance with all statutory provisions. This enables companies to benefit from a pension plan designed with flexibility in mind, digital processing and a potentially lighter balance sheet. With our 1e plan, AXA provides a fully digital solution for today’s pension plan needs.

What risks do insureds bear?

In a 1e pension plan, insureds bear the full investment risk for the 1e pension savings themselves – there are no guarantees as with the mandatory Pillar 2. This means that price fluctuations and losses are possible. At the same time, when market developments are positive, insureds receive the full net return on their investments. The personal risk profile aids in selecting a suitable strategy.

How does AXA’s 1e online solution work?

Employees receive a personal myAXA login with access to the AXA pensions portal. There they answer a few questions to work out their personal risk profile and choose their preferred investment strategy. They can change it at any time online.

What happens if an employee changes jobs?

If an employee leaves your company, their retirement savings must be transferred to the pension fund of the new employer.

Does the 1e pension solution offer tax advantages?

Yes, the same rules normally apply to 1e savings as to other pension savings. There is no wealth tax on retirement savings, nor is there income tax on returns. You can also deduct voluntary purchases from your taxable income.