Collective foundations in a nutshell

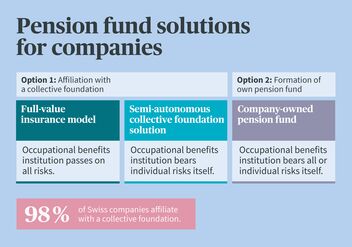

Every company needs occupational benefits insurance for its employees. Business owners can also found their own pension fund or affiliate with a collective foundation. In Switzerland, there are altogether more than 1,000 company pension funds and around 230 collective foundations with which companies can affiliate. Approximately 98 percent of Swiss companies – particularly small and medium-sized ones – currently opt for a collective foundation solution, as setting up and managing their own fund would be too time consuming and expensive. We’ve summarized for you what collective foundations are all about, their advantages, and their disadvantages.

Affiliating with a collective foundation: Possible with two pension models

There are basically two pension models available when affiliating with a collective foundation in Switzerland: full-value insurance and a semi-autonomous collective foundation solution.

As there are only a handful of providers of full-value insurance solutions in the Swiss pension fund market and the trend is for semi-autonomous solutions, we will only be looking at the semi-autonomous collective foundations.

What is a collective foundation?

A collective foundation is a legally independent institution with which companies can affiliate to provide occupational pensions for their employees. This affiliation results in synergies for all affiliated companies, for example in that the capital of all companies is invested together or that the fixed costs of managing a pension fund are shared.

To summarize: A collective fund offers companies the possibility of operating a pension fund without having to manage it themselves.

How does a collective foundation work?

To understand how a collective foundation works, you have to know what bodies it has and what their responsibilities are. The Board of Trustees is the executive body of a collective foundation. It comprises employees and employers from the affiliated companies and is elected regularly (on average every XX years). The Board of Trustees decides what risks the foundation should bear itself, and what should be reinsured by an insurer. It appoints the operational management, the fund management, and other bodies. It also determines the investment strategy, according to which the pension assets are invested. The foundation is supervised by the cantonal Foundation Supervision.

A collective foundation manages a separate occupational benefits fund for each affiliated company. Each occupational benefits fund is obligated to elect an occupational benefits fund commission (OBFC). This is comprised of equal numbers of employer and employee representatives from the company. The OFBC adopts the relevant occupational benefits plan for the insureds in the occupational benefits fund. This defines the contributions and the occupational benefits due at retirement and in the event of death or disability. The company deducts the employee contributions due from the salary and transfers them together with its own contributions to the collective foundation.

Overview of the bodies of a collective foundation

Board of Trustees

- highest decision-making body

- responsible for determining the investment strategy, sets the strategic objectives and principles of the foundation

- defines the organization of the foundation

- appointed from employers and employees of all affiliated companies

- comprises an equal number of employer and employee representatives

Operational management

- frequently rests with a specialist service company or insurance company

- is liable to the foundation

Asset manager

- responsible for implementation of the investment strategy

- appointed by the Board of Trustees

Occupational benefits fund commission

- issues and makes changes to the occupational benefit fund's pension plan

- decides on the financing of the occupational benefits fund

Insurer

- responsible for reinsurance of disability and death

Did you know?

When collective foundations were first set up, the Board of Trustees of a collective foundation comprised only representatives of the founder company acting in the background. This changed with the first revision of the BVG in 2004. The equal balance between employers and employees ensures they have better control of and involvement in the structure of their occupational benefits fund.

How do I find the right collective foundation for my company?

Business owners can compare different collective foundation solutions using the latest figures and see from these how the individual collective foundations manage the contributions of their insured members and whether they are able to meet their obligations without any issues.

The most important factors when evaluating collective foundation solutions

Depending on preference, flexibility in structuring occupational benefit plans, advisory services for employers and insureds, straightforward handling and management of occupational benefits using online tools for employers and insured, or attractive additional services such as fringe benefits may play an important role in choosing a collective foundation solution. In addition, collective foundation solutions can be evaluated using the following key figures.

Relevant key figures of collective foundations

The coverage ratio provides information on the ratio of the foundation's assets to its obligations. However, it is only a simplified snapshot and cannot give a comprehensive view of the structural risk capacity and performance of a collective foundation (other factors must be taken into account here, link to CR blog). A coverage ratio of between 104 and 110 percent is considered healthy .

The size and structure of the collective foundation also play an important role. In particular, this refers to the ratio of active insureds and pensioners and the average age of insureds. As a general rule: The more insureds than pensioners there are and the lower the average age of the insureds, the better.

Tip: All relevant key figures are published in the pension fund's annual report. This is often also available on the website of the respective pension fund. Alternatively, it can be requested from the foundation.

When choosing a collective foundation, it is worthwhile taking a close look and comparing key figures. However, it isn’t just the key figures that need to be right for you but the package as a whole – depending on what is important for you and your employees.