What is a partner pension?

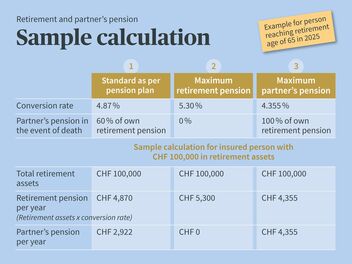

As soon as you retire, you can decide how you want to draw your retirement benefits under the 2nd pillar; in other words, your pension fund benefits. You can decide between a lump-sum payment, a lifelong retirement annuity, or a hybrid form. If a retirement pension in the form of an annuity is chosen, a partner pension amounting to 60 percent of the retirement pension is generally also insured, with this being paid out in accordance with the occupational benefits fund regulations in the event of death.

If the recipient of a retirement pension dies, the partner is entitled to a partner pension under the 2nd pillar provided the requirements set out in the occupational benefits fund regulations are met. In the event of death, the partner pension then replaces the retirement pension that has been paid out until that point and is in turn paid out to the surviving partner.

With the AXA Foundation for Supplementary Benefits, you have the option of adjusting the amount of your retirement pension/partner pension in line with your particular circumstances and financial means.