Key points at a glance

- Quality and value: AXA Real Estate Fund Switzerland invests in high-quality Swiss residential and commercial properties as well as mixed-use properties. The focus is on the residential sector with a 60% proportion.

- Stable performance: the unlisted NAV-valued fund aims to deliver performance and distributions that are both stable and continuous.

- Experience that pays: our experienced and skilled real estate experts manage more than 750 properties with a volume of over CHF 18 billion.

What makes the AXA Real Estate Fund Switzerland stand out?

The fund invests for the long term and offers a solid, sustainable real estate portfolio with the following characteristics:

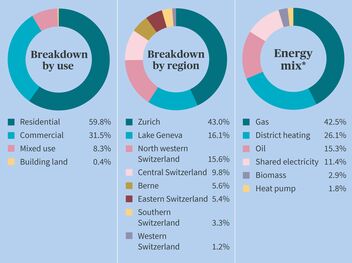

- Portfolio comprising core real estate: focus on the residential sector and prime commercial properties in attractive locations (see chart)

- High stability: real estate investments with stable income and values as well as low vacancy rates

- Highly diversified: geographic distribution, type of use, size of property and tenant mix (see chart)

- NAV-based unit prices: lower price fluctuations (no premium/discount)

- Ecological goal: A climate neutral portfolio (net zero carbon emissions) in terms of heating and utilities by 2050 at the latest (Scope 1, 2 & 3.13, GHG Protocol)

- High confidence level: AXA's pension fund also invests in the AXA Real Estate Fund Switzerland

You can find all details on the AXA Real Estate Funds Switzerland in the Fund Center.

What sets us apart as real estate experts

- AXA Switzerland and AXA Investment Managers are experienced and skilled real estate experts

- As an investment manager, AXA Investment Managers manages more than 750 properties in Switzerland with a volume of over CHF 18 billion (as at 31 December 2023)

- AXA Investment Managers is the largest real estate asset manager in Europe by managing assets of EUR 84 billion (as at 31 December 2023)

Frequently asked questions

What are the opportunities for investments in unlisted real estate funds?

- Stable cash inflows

- Should continue to help stabilize the value of the portfolio as a whole in the future

- Additional diversification

- Easy access to an indirect and diversified real estate investment

- Property valuation at net asset value (no premium)

What are the risks of investments in unlisted real estate funds?

- Limited liquidity (limited tradability)

- As well as leading to upward revaluations, valuation adjustments applied to real estate can also result in devaluations and therefore in a lower net asset value

- Changes in the interest rate environment can have a strong impact on the performance of real estate investments

How high is the applicable discount rate for valuing real estate?

The nominally applied discount rate stands at 3.66 percent and the cap rate at 2.66 percent (March 2025).

Contact

Nicolas Cadalbert

Relationship Manager AXA Asset Management

Peter Damianov

Head Portfolio Management AXA Asset Management