Key points at a glance

- Swiss and risk-aware: AXA invests exclusively in mortgages secured by Swiss real estate.

- Attractive returns and additional diversification: The Investment Foundation AXA Occupational Benefits Mortgages Switzerland offers attractive returns with additional diversification for your overall portfolio.

- Large volumes, wealth of experience: We manage mortgage volumes in excess of CHF 11.5 billion in total and have been investing in mortgages for more than 50 years.

Investment Foundation AXA Occupational Benefits Mortgages Switzerland

The AXA Occupational Benefits Mortgages Switzerland investment group invests in accordance with AXA’s risk-aware investment philosophy in mortgages secured in Switzerland. The focus is on residential real estate with a low average loan-to-value ratio. The real estate that serves as collateral is very conservatively valued relative to the market by AXA’s real estate appraisers. This approach results in an approximately 25% lower lending basis and provides investors with increased security. The mortgages are issued in accordance with AXA’s risk-aware corporate philosophy via its distribution network across the whole of Switzerland. AXA manages mortgage volumes in excess of CHF 11.5 billion in total and has been investing in mortgages for more than 50 years.

This is also reflected in the AXA Occupational Benefits Mortgages Switzerland investment group. The product features the following characteristics:

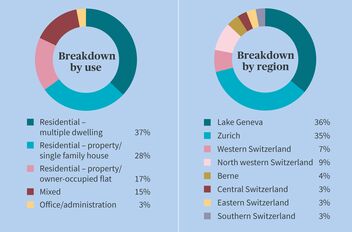

- Focus on residential real estate (see diagram entitled "Breakdown of use")

- Stable income

- Broad diversification across the most attractive regions in Switzerland (see "Breakdown by region” chart)

- Low average loan-to-value ratio

- First-class debtors and high collateral

- Lower duration than the broadly based Swiss bond index, albeit with a higher yield to maturity

- Tradable monthly (notice period of three months for redeeming units)

Sustainability Report of AXA Occupational Benefits Mortgages Switzerland

The AXA Occupational Benefits investment group Mortgages Switzerland takes ESG aspects into account in the investment process according to clearly defined principles. The associated sustainability report provides transparent disclosure of ESG efforts. You can order the report at anlageloesungen@axa.ch.

What exactly is it that characterizes AXA as an asset manager?

- The dense distribution network of more than 340 agencies throughout Switzerland guarantees a constant supply of prime mortgages.

- AXA manages mortgages with a total volume of CHF 11.5 billion.

- Overall, AXA manages some 12,000 mortgages.

- AXA has over 50 years of experience in investing in mortgages.

- The AXA Switzerland Pension Fund also invests in the AXA Occupational Benefits Swiss Real Estate investment foundation.

Frequently asked questions

Why are mortgages considered to be an attractive investment alternative?

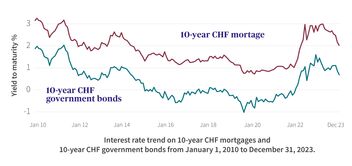

Swiss mortgages are being used as an attractive investment alternative that offers security comparable with CHF-denominated bonds. Viewed historically, the yield to maturity of ten-year Swiss mortgages is higher than that of the SBI Total AAA-BBB Index. This means that investments in mortgages can yield an extra return.

As of December 31, 2024

What are the opportunities and risks of investments in mortgage investment foundations?

Opportunities

- Attractive extra return relative to CHF-denominated bonds

- Additional diversification across the entire portfolio

- Security on a par with CHF-denominated bonds

- Easy access to indirect, diversified investments

- Under OPO2, mortgages can also be assigned to the bond component.

- Additional security through real estate pledges

Risks

- Liquidity (limited tradability)

- Corrections to real estate valuations result in lower collateral and can lead to obligations to furnish additional cover in the case of high loan-to-value ratios

Why have investments in mortgages increasingly become the focus of pension funds?

On the one hand, mortgages increase the level of diversification in portfolios and thus make them more stable. On the other hand, the low-interest phase accelerated investments in mortgages. Pension funds were almost forced to structure their portfolios more efficiently while interest rates remained low. The excess return of around one percentage point that mortgages offer compared with Swiss government bonds is also sure to have been a factor for investment interest.

Mortgage investments are not entirely comparable to bonds. What do pension funds need to bear in mind when they invest in mortgages?

The Investment Foundation AXA Occupational Benefits Mortgages Switzerland values mortgages at market value, just like bonds. This means that changes in interest rates can cause fluctuations in the portfolio. Duration is thus a key factor with regard to mortgages. AXA Pension Mortgages Switzerland, for example, has a shorter duration than the usual benchmarks. It is therefore less sensitive to interest rates and thus exhibits fewer fluctuations in the event of interest rate movements.

Mortgages are also less liquid than bonds. Investments in the Investment Foundation AXA Occupational Benefits Mortgages Switzerland are possible monthly. Withdrawals can also be made monthly, subject to three months’ notice. Other factors to bear in mind include which types of property are being financed, where they are located, and how they are used. Residential properties, for instance, are classed as less risky than commercial properties. Loan-to-value ratios are important too. They are a means of gaging the probability of default on a mortgage and thus calculating its risk.

How likely are defaults among mortgages?

In the case of Swiss government bonds, the borrower is the Confederation. In the case of corporate bonds, it is a company. Swiss government bonds are seen as safe because their probability of default is very low. In the case of mortgages, the debtor is the individual borrower. However, in contrast to government and corporate bonds, the loan is secured by the property it is used to finance.

The mortgage lender’s terms and conditions and the quality of the property are thus vitally important in terms of minimizing the risk of default.

AXA maintains high standards of security in its mortgage lending, and these are reflected in a selective approach to accepting borrowers. For example, it only allows borrowers to withdraw occupational benefits early if they have already provided at least 20% of the purchase price from their savings. AXA also finances mainly owner-occupied residential properties and completely excludes, for example, luxury properties, vacation homes, and industrial facilities.