Becoming self-employed in Switzerland: The checklist for founding a company

Realize your dream of having your own company – it’s really not that complicated to do. What do you need to bear in mind if you want to become self-employed? We’ve compiled the most important tips for starting a company in Switzerland for you here.

From the business idea and selecting the right legal form, to insurance and pension solutions – we go through the most important steps in founding a company together with you. Let’s get started!

The checklist: 10 steps to self-employment

4. Determine your need for capital

5. Choose a suitable legal form

7. Consider the necessary social insurance

8. Determine your insurance needs

9. Take tax aspects into account

10. Don’t forget retirement provision

1. Develop your business idea

Everything starts with a good business idea. Nevertheless, if you want to found your own company, you don’t necessarily have to reinvent the wheel. You can buy an existing company, for example, or consider opening a franchise.

Or you can proceed with an existing business idea and improve on it. The majority of founders start with products and services that they are already familiar with. The big advantage here is that if you have worked successfully for many years in a certain field, then you know the central needs and problems of the market. Close contact with customers is a revealing source of information when it comes to improvements, product innovations, and gaps in the market. Industry insiders also have the right network and know potential customers and suppliers personally. Ideally, you also work in an ambitious team which supports you in growing your business.

If you want to launch something completely novel on the market, it is a unique opportunity, but also a major challenge. For this reason, new ideas always need to solve an existing problem and/or improve the status quo. This is the case if you are cheaper, more efficient, simpler, or more holistic than your competitors .

No matter which business idea you go for: A market analysis is a good first step to estimate the potential of your idea. A business model canvas can also help you to visualize your idea and determine any possible weak points.

2. Create a business plan

You have settled on a business idea. Now you have to turn it into reality. A business plan is good way to do so.

From your company’s objective to competitors and pricing policy: With a business plan, you turn your idea into a fully fledged strategy. It serves as the guidelines for the development of your company and can be provided to financial institutions to raise capital, for example. That’s why it is important to update your business plan regularly. That way, you can ensure that you don’t lose sight of the goal you set when you became self-employed.

Does making a business plan sound like a lot of work? The Swiss SME portal provides founders with free templates and samples .

3. Find a company name

Do you already have some initial ideas for a company name? When choosing your company’s name, make sure you don’t infringe on any trademark rights. You should also check whether the corresponding domain is available for your website. Depending on the marketing concept, you should also see whether you can create social media profiles with the name and whether the name has already been taken by other users.

Good to know: Depending on the legal form you choose, you may have to include certain elements and observe certain requirements for the company name. For a sole proprietorship, your last name must be a part of the company name, for example. On the other hand, for a GmbH or AG, the legal form must be part of the name.

The following provisions set out the most important rules for creating a company name:

- General principles of business name composition: Art. 944 et seq. CO

- Commercial Register Ordinance: Art. 26 CRO

- Helpful tips on what to avoid: Instructions and directive to the commercial registry authorities on the creation and review of companies and names (in German)

Tip: Check the company name in advance

If your company name violates the rules on company founding, then it cannot be entered in the commercial register. If you want to check before founding the company whether the company name complies with the legal provisions, you can submit your proposal to the competent cantonal commercial registry office for advance review.

To the overview of all cantonal commercial registry offices

4. Determine your need for capital

Start-up founders have lots of options when it comes to funding their business model. For example:

- Raising money from investors or business angels

- Income from crowdfunding

- Equity, for example pension fund savings

- Debt capital, for example taking out a loan from a bank

The amount of capital you need to found your company depends on various factors. For example, the required start-up capital varies greatly by legal form:

- Sole proprietorship: There aren’t any rules on start-up capital for sole proprietorships.

- GmbH: A GmbH (limited liability company) must have nominal capital of at least CHF 20,000. It's good to know that after the company’s founding has been published in the Swiss Commercial Gazette, the money is returned to the business account of your company and is at your disposal. The blocked account opened for the share capital is closed.

- AG: An AG (company limited by shares) must have share capital of at least CHF 100,000. Although 20% of the nominal value of every share or at least CHF 50,000 is enough, we nevertheless recommend having the full CHF 100,000 available because of the obligation to provide additional capital.

Other costs besides start-up capital are incurred when you start a company. In addition to one-time payments, there are also ongoing expenses, such as your own cost of living, the rent for your shop space, employee wages, procurement costs for equipment and inventory, and budgets for marketing measures.

Tip: Plan for a bridging reserve

Take the time to determine what your capital requirements are and obtain advice. Tight finances represent a significant risk: In the event of bankruptcy, sole proprietors can be held liable in a worst-case scenario with their personal wealth. That’s why we recommend planning for a bridging reserve covering at least six months. You can obtain professional advice on start-up platforms such as startups.ch, from business coaches, your bank, or in one of AXA’s liquidity planning workshops:

Do start-ups and self-employed persons receive financial support?

The federal government does not grant any direct financial support for the founding of new companies. Instead, it strives to create favorable conditions for founding new companies. The only exception is unemployment insurance: It provides support measures for unemployed persons who would like to start their own company. New start-ups can obtain additional support in the form of scholarships, subsidies, competition prizes, or research funds from universities, for example.

5. Choose a suitable legal form

Sole proprietorship, partnership, or corporation – the choice is yours when you want to become self-employed. If an individual is managing a business in the commercial sense under his or her own name and on his or her own behalf, this constitutes a sole proprietorship. This legal form is popular and the gateway to self-employment for many start-ups.

What is a sole proprietorship?

A sole proprietorship consists of a sole business owner. To have a sole proprietorship, you must be recognized as self-employed by your compensation fund. Founders of this legal form remain natural persons.

If you’re a sole proprietor, you qualify as self-employed.

What is a limited company?

In the case of corporations, the focus is on the capital paid in. In Switzerland, the AG (Aktiengesellschaft – joint-stock company) and GmbH (Gesellschaft mit beschränkter Haftung – limited liability company) are very popular. As a legal entity , the corporation is given its legal capacity upon entry in the commercial register. For liabilities, the AG and GmbH are liable with the company’s assets.

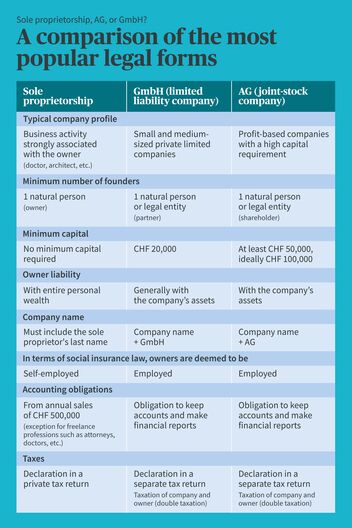

Sole proprietorship, AG, or GmbH? A comparison of the most popular legal forms

6. Found your company

Are you ready to become self-employed? Then it’s time for the actual company founding. The founding process varies depending on the type of legal form.

How to found a sole proprietorship

A sole proprietorship is created once a business activity begins – and not through an entry in the commercial register as with GmbHs or AGs. Only from a generated annual revenue of at least CHF 100,000 are you obligated as the owner of a sole proprietorship managed as a commercial enterprise to have your company entered in the commercial register.

It’s important to note that to qualify as self-employed in Switzerland, you have to have your self-employment reviewed and recognized by the responsible compensation office (AHV). Once you have started your business activity in self-employment, you have to register with the compensation office to do so. The compensation office of the canton where your company is domiciled is responsible.

To review your application, the compensation office needs proof of self-employment. That’s why registration is retroactive. Include documents with your application that prove you are self-employed. These may comprise, for example, offers and invoices, advertising materials, or a description of your activity. An entry in the commercial register is not enough for approval of self-employment.

How to found a GmbH or AG

A corporation such as a GmbH or AG is founded with an entry in the commercial register and the founders’ meeting of partners in the presence of a notary (public notarization).

- For a GmbH, the articles of incorporation also have to be approved, and the managing directors as well as auditors in some cases have to be determined.

- For an AG, the articles of incorporation have to be approved, and the board of directors as well as auditors have to be determined.

Through the founding, your company obtains a legal capacity and is from that time considered to be a legal entity.

The commercial registry office of the canton where your company is domiciled is responsible for registration. You will find an overview of the required documents and data from your commercial registry office.

Entry in the commercial register and the founders’ meeting are mandatory

To register the company with the commercial registry office, information on the persons to be entered in the commercial register, the officially notarized signatures of the founders (GmbH) or the members of the board of directors (AG), as well as the notarized founding documents are required, for example. You can obtain help for preparing founding documents from attorneys, notaries, or fiduciaries.

During the registration process, GmbHs and AGs also have to provide information about their organization, such as the management regulations (GmbH) or regulations of the board of directors (AG). For this reason, you should clarify the following points before you submit your commercial register entry:

- Definition of the amount of share capital and distribution of shares

- GmbH: At least CHF 20,000 must be paid in as share capital and the shares (with a value of at least CHF 100) must be distributed among the founders.

- AG: Share capital must amount to at least CHF 50,000; however, due to the obligation to provide additional capital, we recommend CHF 100,000. Once the minimum value of the shares has been determined (at least CHF 0.01 per share), the shares are distributed among the founders.

- Determining the partner entities

- GmbH: The partners share management responsibilities, provided nothing else has been defined.

- AG: The board of directors is responsible for the management board. The founders decide who will serve on the board of directors.

Submitting documents to the commercial register

Once you have compiled all the founding documents, we recommend having the registration draft reviewed in advance by the commercial registry office. In addition, submit the documents that need to be notarized to your notary in good time and arrange an appointment for the notarization of the founders’ meeting.

If you have finished all preparations, submit your registration in person or by mail to the commercial registry office. After the review has been completed, the entry will be made in the cantonal commercial register within approximately seven days. The entry in the Swiss Federal Commercial Registry Office and publication in the Swiss Commercial Gazette SHAB is made after that.

Finished! Your corporation has been successfully founded. If you provide your bank with your extract from the commercial registry, you can then access your share capital and immediately have the complete power to act.

7. Consider the necessary social insurance

Social insurance serves as a social safety net for the Swiss population. It includes obligatory insurance that cover basic risks. It pays benefits in the form of pensions or contributes to covering costs in the event of an accident or illness. Social insurance includes, for example, old-age and survivors’ insurance (AHV), occupational benefits insurance (BVG), maternity insurance (MV), and accident insurance (UV).

Employees in Switzerland are automatically insured under AHV and have mandatory coverage against invalidity, death, and poverty in old age. On the other hand, self-employed persons are obligated to take care of their own insurance. The legal form of the company thus determines their position under social insurance law as the owner – and whether they have to register with AHV independently.

Register with the compensation office (AHV)

- Sole proprietorship: In Switzerland, you first qualify as self-employed once the compensation office of the canton you work in has reviewed your application and approved your self-employment. Under social insurance law, you are deemed to be self-employed if

- you work under your own name and for your own account,

- you’re independent, and you bear your own financial risk.

- GmbH or AG: If you found a corporation and conclude an employment agreement with this company, you will be deemed to be an employee under social insurance law. Contact the responsible compensation office and family compensation office to register your employees or to apply for family allowances.

Tips for registering with AHV

- Save time by registering online: Registration with the compensation office is free of charge and can be done online. Depending on the legal form, it takes around 20 to30 minutes.

To the registration for AHV/IV/EO/ALV at easygov

- Understand your AHV statement:

- Your cantonal compensation office sends you a provisional bill every quarter for the previous quarter. The amount due is based on the information you provide or on the numbers from the previous year.

- As soon as the cantonal tax office has reported your income from self-employment, the compensation office can issue the final bill.

- Report any material changes to your income (of 25% or more) to your compensation fund in the following year at the latest to avoid back payments with default interest.

- Check your AHV account statement: The compensation fund recommends self-employed persons check their AHV account statement every five years. It can be obtained free of charge from your cantonal compensation office. Do the amounts entered correspond to the income subject to contributions that is indicated in your tax declaration? The AHV account statement only shows the years with a definitive contribution statement. You can order your AHV account statement free of charge from you cantonal compensation office.

- Avoid pension and contribution gaps:

- Only women who have paid AHV contributions for 43 years and men who have paid for 44 years will receive a full old-age pension.

- Daily sickness and accident benefits insurance is voluntary. Contribution gaps may occur as the result of extended illnesses or accidents. We recommend closing these gaps in good time to prevent any effects on your AHV pension.

- Missing contributions can be paid up to five years later. To do so, contact your compensation office.

Budget for social insurance contributions

We recommend calculating the costs for social insurance as normal expenses in your budget. Social insurance is obligatory or voluntary, depending on the legal form of your company:

- Sole proprietorship: Under social insurance law, you are deemed to be self-employed. For you as the owner, the following applies:

- 1st pillar (AHV/IV /EO), family allowances = Obligatory

- 2nd pillar (pension fund) = Voluntary

- Daily benefits insurance = Not obligatory for owners, but customary

- Accident insurance = Not obligatory, but customary (however, it is obligatory to include “accident” in basic insurance)

- GmbH or AG: Unlike sole proprietorships, you as the (co-)owner of an AG or GmbH are deemed under social security law to be an employee.

- 1st pillar (AHV; IV; EO), family allowances = Obligatory for you and your employees

- 2nd pillar (pension fund) = Obligatory for you and your employees, if the annual gross income exceeds CHF 22,680 (as at 2026)

- Unemployment insurance: Obligatory for you and your employees

- Daily benefits insurance = Not obligatory, but customary due to legal obligation to continue paying salary.

- Accident insurance = Obligatory for you and your employees for occupational accidents; also obligatory for non-occupational accidents from more than eight working hours per week

Does your start-up already have employees? How social insurance works for employees

Employing staff comes with certain obligations attached. In Switzerland, for example, the law requires that all employees be insured against disability, death, and poverty in old age. Employers must pay social insurance contributions. These include employer and employee contributions to AHV, IV, EO, and unemployment insurance, as well as employer contributions to family allowances.

These employee social insurance contributions are handled through your compensation office. All employees must also be insured against occupational accidents and disease.

An overview of the required registrations:

- Compensation office:

- Employees who already have an AHV number can simply be listed on your salary declaration at the end of the year.

- You must notify the compensation office within one month of cross-border commuters who don’t have an AHV number and employees moving to Switzerland from abroad.

- Employees whose contracts have been terminated need only be reported to the compensation office if they claim a family allowance.

- Mandatory accident insurance:

- Occupational accident insurance is sufficient for employees who work fewer than eight hours a week.

- Employees who work more than eight hours a week must also be insured against non-occupational accidents.

- If your company isn’t insured by law with the Swiss National Accident Insurance Fund (SUVA), you can get this insurance from a private insurer, a health insurer, or a public accident insurance fund.

- Daily benefits insurance: This makes sense in view of the legal obligation to continue paying salary.

- Pension fund: Occupational benefits insurance is mandatory for employees whose gross income is more than CHF 22,680 a year (as at 2026)

- Family allowance: Your employees are entitled to a family allowance for children under 16. The same applies to children aged 16 to25 in full-time education.

- Certain conditions apply. Send the application form to the compensation office. If the conditions are met, the compensation office will send you a confirmation.

- The family allowance will be set against your social insurance contributions.

8. Determine your insurance needs

Supplementary to social insurance, so-called business insurance covers risks that could be dangerous to your company in the start-up phase.

Whether work-related absences, technical interruptions, or cyber attacks: Business insurance protects against incidents that can throw your dream of self-employment off course. For this reason, you should ask the following questions when choosing the right insurance: Which risks will my young company face? And which can I or do I want to bear on my own, and which do I want to pass on to my insurance?

The good news is that for start-ups and self-employed persons, most occupational benefit insurance policies can be freely chosen. You can find out more about what you should bear in mind on our pages “Insurance for the self-employed and & start-ups” and in our practical insurance check:

9. Take tax aspects into account

Another point you should consider when planning your budget: Taxes. Here, too, the legal form of your company plays an important role:

- Sole proprietorship: Owners of a sole proprietorship have to tax their income as well as their business and private assets. To do so, a tax declaration must be submitted based on the business bookkeeping and private wealth.

- AGs or GmbHs: Corporations qualify as legal entities and have to pay taxes on capital and profits. If a GmbH or AG generates a profit and distributes it in the form of a dividend, both the company itself and the individual partners are taxed. This is referred to as double taxation, since in addition to the declaration for employment with the GmbH or AG, a private tax declaration also has to be submitted. The private income and the dividend income of the partner are therefore taxed.

This overview from SECO shows which taxes are levied at a federal, cantonal, and municipal level depending on the legal form.

Tip: Are you liable for VAT?

When it comes to value-added tax, the legal form of your company plays a subordinate role. The rule of thumb is that If you generate annual revenues with your company of at least CHF 100,000 for services rendered in Switzerland then you are subject to value-added tax. You then have to account for two things:

- You’re required to have your company entered in the commercial register. The cantonal commercial registry office at the company’s domicile is responsible for this.

- If you are subject to value-added tax with your company then as soon as you meet the conditions for tax obligations, you must register with the Federal Tax Administration in writing within 30 days.

10. Don’t forget retirement provision

Many founders think of themselves last. However, you should certainly not forget your personal retirement provision. Here, too, your company’s legal form sets the framework conditions:

- Sole proprietorship: For the self-employed, occupational benefits insurance (pillar 2) is optional. Many owners of sole proprietorships, general or limited partnerships voluntarily join a pension foundation. As an alternative, self-employed persons can fall back on pillar 3a . In addition to long-term security, you benefit here from attractive tax advantages.

- GmbH & AG: if you set up a company limited by shares (AG) or a limited liability company (GmbH), you’re considered to be an employee of your own firm for insurance purposes. Your pension fund assets must then be transferred into the new pension fund. You can privately save for your retirement as before with pillar 3a and 3b .

Finished!

Congratulations! You’ve taken the bold leap into self-employment and started your own company!

The adventure of being an entrepreneur can begin: The first few months and years are decisive for establishing your young start-up. How will your company assert itself on the market? When will it notch up its first big success? Is the legal form you chose in the beginning still the right one? Is it time to switch to an AG or a GmbH?

The AXA team will be happy to provide impartial advice and valuable tips, even after you start your company. Contact us – we’ll get back to you shortly.