Transition to net zero

The scientific evidence is clear – global warming is a reality that brings with it risks and uncertainty. We want to help minimize these risks. This is why the AXA Group strives to continually reduce its carbon emissions while also supporting carbon reductions in the economy and society in order to make a contribution to the global goal of net zero emissions by 2050.

Net zero strategy for investments and insurance

Working to lower the risks of climate warming is part of our overall strategy – for both our corporate and our investment strategy. Our goal is to bring our business in line with the Paris Agreement. Strategic measures we plan to take in order to reduce carbon emissions over the long term and to drive the transition to a low-carbon economy include, among other things, a net-zero emissions target by 2050 for our investments and insurance portfolios, investments in the transition (e.g. green bonds and certified real estate), support for companies on their way to becoming climate neutral and a complete exit from the coal industry by 2040.

No profit from coal

Coal is one of the most carbon-intensive energy sources and remains one of the biggest causes of man-made emissions that contribute to increasing the concentration of CO2 in the atmosphere. Scientific studies show that reducing coal dependency is vital if we are to minimize greenhouse gas emissions and limit global warming. In 2015, the AXA Group became the first major insurance company to announce that it would start to gradually pull out of the coal industry. In concrete terms, this means that by 2030 we do not intend to have any assets invested in coal companies in OECD or EU countries, nor will we insure them. We intend to complete our exit from coal worldwide by 2040.

“A 4-degree warmer world is not insurable.”

1.5 degree Celsius global warming potential and net zero emissions by 2050

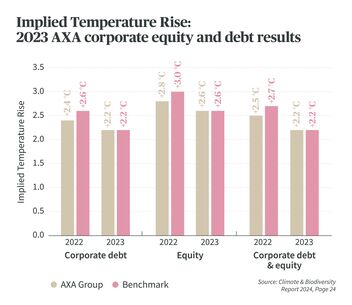

In line with the Paris Climate Agreement, the AXA Group has set itself the goal of limiting the global warming potential of its equity and debt investments to less than 1.5 degrees Celsius by 2050 compared to pre-industrialization levels. Since 2022, the AXA Group has been using the Implied Temperature Rise (ITR) from MSCI ESG Research. ITR is a forward-looking metric, expressed in degrees Celsius, designed to show the temperature alignment of companies, portfolios and funds with global temperature goals.

ITR for the AXA Group

The ITR for the AXA Group trended as follows between 2022 and 2023:

- The ITR for debt capital (corporate bonds): +2.2 degrees.

The ITR for debt capital dropped by 0.2 degrees from +2.4°C to +2.2°C. - The ITR for equity (shares): +2.6 degrees.

The ITR for equity dropped by 0.2 degrees from +2.8°C to +2.6°C. - The ITR for equity and debt capital (corporate bonds and shares): +2.2°C.

This means the ITR fell from +2.5°C to +2.2°C, which is a 0.3 degree decrease.

According to the Climate and Biodiversity Report published by the AXA Group, the Implied Temperature Rise for the AXA Group portfolio stands at 2.2 degrees, which is the same as the market average. However, this figure also shows that concerted efforts are needed to decarbonize the economy as a whole and limit global warming to 1.5 degrees, as called for by scientists and policymakers in order to limit the risk of climate change impacts.

Net Zero Asset Owner Alliance

Since 2019, the AXA Group has been a member of the Net Zero Asset Owner Alliance. The members of this alliance – currently more than 40 institutional investors with around USD 6.6 trillion in assets – have pledged to reduce the carbon emissions of their investment portfolios to net zero by 2050. They also plan to collaborate to improve measurement methodology and promote the transition to a low-carbon economy. The AXA Group has set a reduction path and an interim target to reduce the carbon intensity of its own investments by 50 percent between 2019 and 2030. And so over the next few years, this will allow AXA to begin making an important contribution to achieving its net zero target by 2050.

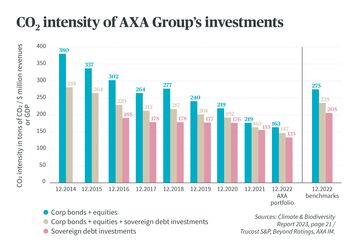

Reducing our carbon intensity

Being transparent about the impact of our investments is important to us, as is the disclosure of greenhouse gas emissions associated with our investment activities. As part of its commitment to the Montreal Carbon Pledge, the AXA Group has published the carbon footprint or the carbon intensity of its investments (listed shares and corporate bonds) every year since 2014. The data is consolidated and analyzed for all AXA country units. The data for AXA Switzerland is also included. The carbon footprint of our own investments is steadily decreasing and fell by 69 percent between 2014 and 2023 for the AXA Group.

Support for the transition to low-carbon business models

Transition Bonds were designed by the AXA Group and Crédit Agricole CIB. They support projects by companies that are carbon-intensive today but are working to make improvements and can play an important role in decarbonizing the economy. AXA’s Transition Bonds bridge the gap between projects that are eligible for green bond financing and those that are not but could still make great strides in reducing carbon emissions. For example, the conversion from heavy fuel oil to liquefied natural gas engines can be financed for shipping companies until they are able to switch to wind or hydrogen-powered ships.

How does the AXA Group actually invest in climate protection?

- The goal is to reduce the global warming potential of our own investments to 1.5 degrees by 2050.

- No investments in companies that derive more than 15 percent in sales revenues from coal mining or from the generation of energy from coal, among other things (exit from these investments by 2030 for OECD countries and by 2040 globally)

- EUR 5 billion per year in investments in transitioning (e.g. green bonds, Transition Bonds and certified sustainable real estate) by 2030

- No investments in companies from the oil and gas sector, unless they are on our Approved List (Approved List companies have a clear strategy for transitioning to renewable energies)

Our climate strategy

In its role as an insurer, an investor, a company and a corporate citizen, AXA is advocating for climate protection. Through its climate strategy, AXA Switzerland has formulated concrete measures and pursues two main goals of further reducing carbon emissions and adapting to climate change.