Over recent years, the run on real estate has increased sharply. After all, who doesn't dream of owning their own four walls? But owning a property depends essentially on long-term financial affordability. Before you start looking for a suitable property, it's worth taking a careful look at your financial situation.

Being able to buy a "place of your own" - that's still one of the most important life goals in Switzerland. With good reason, as a long-term mortgage is usually cheaper than paying rent for decades. Home ownership also has tax benefits and creates a solid investment in uncertain times. Nonetheless, the growth in demand has driven up the price of land and real estate. That's why potential buyers with a limited budget are often uncertain about whether home ownership is affordable for them at all.

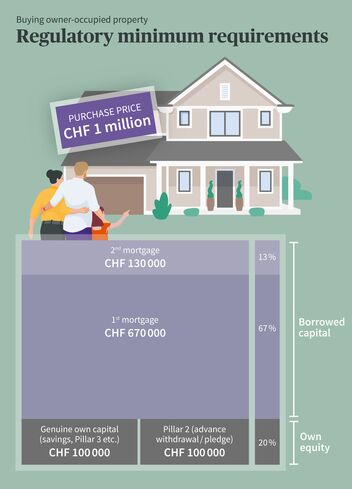

Using the 20:80 rule, at least 20% of the property's value must be funded using your own equity. One half of this 20% must be your own "genuine" capital, such as savings, securities, advances on inheritance or private loans. The other half must be in the from of an advance withdrawal or a pledge from the pension fund (Pillar 2). Those are the regulatory requirements - some mortgage institutions have much stricter criteria for granting loans.

The remaining 80% of the purchase price may be funded using borrowed capital. Tip: the higher the equity ratio, the lower the interest payments and affordability level. However, you should never invest all your liquid assets into buying a house, as you can't access this money in an emergency.

It's worth pointing out that voluntary Pillar 3 is ideally suited for saving money to buy your own home. And with Pillar 3a, you also save tax at the same time.

Source: Own depiction

The living costs for your property should not exceed one third of your gross income, as this is the only way to guarantee affordability. Apart from mortgage interest, there are also amortization and maintenance costs to be added to living costs. Note: although interest rates are currently low, a long-term average interest rate of 5% is used to calculate the maximum mortgage loan - the technical term for this is "imputed mortgage interest".

Mortgages are granted by banks, insurance companies and pension funds. The amount of money they'll lend you depends on your income and wealth. In the first instance, you should therefore check with your bank or insurance company how high your loan can be. Our mortgage calculator helps you work out whether you can afford the home of your dreams.

Secondly, find out which model is the right one for you, i.e. fixed, SARON or variable rate mortgage. A fixed rate mortgage helps with your planning, as a fixed interest rate is set for a period of between two to ten years. However, a fixed rate mortgage is quite inflexible and repaying it early can be very expensive. A SARON mortgage is a hybrid solution of a fixed and variable rate mortgage. This way, you enjoy more flexibility and can benefit from lower interest rates. Variable rate mortgages have no fixed term. They're ideal if you are looking to sell or amortize the mortgage in the near future, but the interest rate is much higher than for fixed rate mortgages.

As soon as you have found the right mortgage model, it becomes specific: obtain three to five offers from different providers for the same product and the same reference date. Compare the terms and conditions, making sure to read the small print as well. Here you'll find out everything important if you're interested in a mortgage with AXA.

A first mortgage may not exceed 66 2/3 % of the property value. If you need more borrowed capital, you still need a second mortgage. Taken together, the first and second mortgages must finance up to 80% of your house purchase, as at least 20% must be available in the form of your own equity.

Banks assume that maintenance and ancillary costs account for between 0.7% and 1% of the overall property value. For a single-family home valued at one million Swiss francs, this would mean CHF 10,000 per annum. Even if this amount seems high, it's realistic: buildings insurance, water and sewage, fuel and garbage disposal as well as maintenance, repairs and replacement of appliances - it all adds up. For older properties, maintenance costs of up to 2.5% should be factored in.

If you finance your house purchase through a pension fund advance withdrawal, the amount you pay in mortgage interest and amortization is reduced, as you need a smaller mortgage loan. However, this type of advance withdrawal will lead to a reduction in your retirement pension and, depending on the pension fund, it may also lead to reductions in benefits in the event of disability or death.

If you pledge your pension fund savings, they are used as additional collateral for your mortgage lender and in return you are granted a larger mortgage loan. The capital stays in the pension fund where it continues to earn interest and there is no reduction in benefits. The disadvantage of this is that you have higher interest and repayment costs as less equity is used to reduce the size of your mortgage.

By law, the second mortgage must be repaid within 15 years, or at the latest by the time you reach retirement age. A mortgage can be repaid in two ways: if you opt for direct repayment, you repay an agreed amount each year. This reduces your mortgage debt and interest expenses, but increases your tax burden.

If you opt for indirect repayment, money is invested in a pension plan in order to accumulate the necessary capital. This insurance policy with an investment component is pledged to the mortgage lender. When the policy matures, the payout is used to repay your second mortgage. Your mortgage debt, interest expense, and tax liability remain the same. At the same time, the integrated insurance cover ensures that payments can be kept up in the event of disability or death. Inflation also indicates direct amortization.

Even though the second mortgage is supposed to be paid off before you retire, living costs drain the limited budget of retirees. Here you can:

The best solution will only become clear just before retirement. Either way however, you must have saved the necessary capital in good time. You should therefore take advantage of the times in which you can set something aside. A good way of doing this is through Pillar 3a – ideally in conjunction with term life insurance.

Even if the funding has to be carefully prepared, it is by some way not the only relevant factor when it comes to home ownership. A number of factors have to align for you to be happy with a property over the long term. This blog post gives you helpful tips that you should consider when it comes to buying a house. It's worth waiting for the offer that suits you best.

And in the meantime, you can calmly review the funding: our interactive guide summarizes all the important aspects and leads you step by step to your dream house.